Photo Illustration by Michael Emono / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

Inside Nigerian Freelancers’ Currency Trap

Photo Illustration by Michael Emono / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

Inside Nigerian Freelancers’ Currency Trap

It is 2:00 a.m. in Lagos, the hum of a generator in the background keeps the lights on for Tunde, who just finished a $1,000 Figma design project for a client in San Francisco. The work is done. The client is happy. But for Tunde, and the millions of freelancers like him, the real headache is just starting—getting paid.

For a remote worker in Berlin, an international transfer is a trivial banking notification. However, for the Nigerian freelancer, it is a navigational hazard involving intermediaries, arbitrage rates, cryptocurrency bridges and the perpetual risk of asset freezing.

Nigeria’s freelance economy is effectively the new labour market. According to the World Bank, Nigeria leads a cohort of 17.5 million online gig workers across sub-Saharan Africa. Driven by a youth demographic where 85.6 per cent of the employed population is self-employed, freelancing is no longer a ‘side hustle’; it is the main event. But a paradox exists. While digital borders are dissolving globally, financial borders are becoming increasingly thick. Beyond the daily payment inconvenience, there is a ‘hidden tax’ on the Nigerian ambition, revealing the extent of Africa’s uneven integration into the global digital economy.

A DECADE OF RESTRICTIONS (2014-2024)

The current payment gridlock is not accidental; it is the result of ten years of defensive monetary policy. Following the oil price crash of 2014–2016, the Central Bank of Nigeria (CBN) admitted in its 2015 Monetary Policy Review that it adopted ‘administrative restrictions’ on foreign exchange (FX) access specifically to protect reserves from the crude oil shock. Rather than allowing the Naira to find its market clearing price, the apex bank banned 41 items from accessing official FX. While intended to protect reserves, this policy signalled the beginning of a divergence between the official economy and the real economy.

For the burgeoning digital workforce, the critical turning point was the systemic tightening of remittance channels. In an attempt to capture diaspora flows, the regulator introduced a series of circulars that inadvertently increased friction. The restriction of International Money Transfer Operators (IMTOs) to ‘inbound-only’ transfers effectively severed the bi-directional flow of capital required for modern commerce.

Ayotunde Abiodun, an analyst at SBM Intelligence, describes this regulatory evolution as ‘tightening dressed as modernization.’ Abiodun points to the January 2024 guidelines, which banned fintechs from obtaining IMTO licenses entirely while raising capital requirements to $1 million. ‘These measures signal risk at every level,’ he notes. ‘They make Nigeria expensive and complicated for global platforms to serve.’ Consequently, the Nigerian freelancer has learnt to view the formal banking sector not as a partner, but as a risk to be managed.

THE REAL COST OF GETTING PAID

Quantifying the Nigerian freelance economy requires looking beyond official GDP figures, which frequently fail to account for the pace of digital trade. If Nigeria’s gig economy were a stock, its valuation would be massive. Official remittance inflows through formal channels surged by 43.5 per cent to $4.73 billion in 2024, pushing total inflows to $20.93 billion. Yet, this likely misses half the picture. When combined with the estimated $22 billion in stablecoin volume processed largely by digital natives, the true value of Nigeria’s remote workforce likely exceeds $40 billion—a figure that rivals the country’s entire foreign reserves.

In cross-border payments, friction functions like a tax on income. Consider the mechanics of a standard $1,000 earnings event on a platform like Upwork.

The erosion begins at the source. Platform service fees of roughly 10 per cent reduce the principal to $900. The capital then encounters the banking hurdle. Attempting to repatriate these funds via traditional SWIFT rails triggers a dual penalty: intermediary bank fees ranging from $25 to $50, as well as arbitrage losses. As of December 2025, the discrepancy between the effective bank counter rate (approximately ₦1,440/$1) and the parallel market rate (approximately ₦1,470/$1) creates a distortion. If Tunde could access the full value of his labour at the current parallel market rate, his work would be worth ₦1.47 million. However, after platform fees and bank charges, and being forced to convert at the lower bank rate, he effectively takes home ₦1.25 million. The differential of over ₦217,000 is effectively a levy on formality rather than a standard transaction fee.

Abiodun frames this precisely as ‘earnings deflection’. The premium paid to bypass this system is ‘a tax on formality, a penalty for using the banking system.’ When sub-Saharan Africa already bears the world’s highest remittance costs (averaging 8.9 per cent per transaction), this additional local friction renders the formal banking route economically irrational. The rational economic agent, faced with a substantial loss in value, will inevitably seek an alternative rail.

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00

THE FLIGHT TO SHADOW RAILS

When formal transaction costs get too high, people find other ways. In Nigeria, this has given rise to a shadow financial infrastructure that is as complex as it is efficient. While the ‘supermarket’ of formal banking suffers from empty shelves, the ‘street market’ of innovation thrives.

The most dominant structural shift is the mass adoption of stablecoins (USDT). For the modern Nigerian creative, platforms like Binance or Bybit have effectively displaced traditional banking institutions as the primary custodians of value. ‘The evidence strongly suggests we are witnessing not a temporary workaround but the early stages of a permanent structural realignment,’ Abiodun notes. Data from SBM Intelligence indicates that between July 2023 and June 2024, Nigeria processed nearly $22 billion in stablecoin transactions—the largest volume in sub-Saharan Africa.

However, Bernard Parah, the CEO of Bitnob, offers a more nuanced forecast. He argues against a total ‘leapfrog’ where banks disappear, predicting instead a convergence where ‘both systems blend together’. ‘I don’t see it as a leapfrog… I see it more as efficiency gains,’ Parah tells me via an email conversation. ‘Traditional institutions have trust, which is the most important component in payments. They will use crypto in the background to make their operations more efficient.’

For Parah, the real revolution is backend settlement. He predicts a generational shift where ‘billions of young people will likely have a crypto wallet before getting a bank account’, forcing traditional rails to adapt or perish by the end of the decade.

Yet, for the freelancer on the ground today, this ‘blending’ remains a messy process. As freelancer Yvonne Ocran observes, ‘Getting your USDT out to local banks is often a struggle.’ The regulatory volatility surrounding peer-to-peer (P2P) markets means freelancers often trade one set of risks, such as banking delays, for another, like regulatory crackdowns. The ‘shadow’ infrastructure lacks the legal protection of the formal system, leaving freelancers vulnerable to scams and frozen wallets.

WHY ARE ALL THESE HAPPENING?

Why is the financial passport of a Nigerian freelancer significantly weaker than that of, say, an Estonian peer? A cycle of local policy and global compliance drives this weakness.

Iyinoluwa Aboyeji, co-founder of Flutterwave and Future Africa, identifies a ‘global trust tax’, a reputational penalty enforced by correspondent banks that view Nigerian transactions through a lens of extreme risk. ‘Nigerian transactions often face higher fees and delays due to the jurisdiction’s perceived risk profile,’ Aboyeji explains. This creates what SBM’s Abiodun describes as a ‘mutually reinforcing system failure’. Local policy creates compliance complexity, such as CBN guidelines restricting IMTOs to inbound-only Naira-payout models. This complexity triggers global de-risking. Major players, such as PayPal, restrict Nigerian accounts to ‘send-only’, while Stripe offers no direct access.

Freelancers like Kelvin Etoma are familiar with this exclusion firsthand. ‘PayPal is supported, but you can’t receive payments as a Nigerian,’ he explains. To bypass this, he had to physically travel abroad to create a functional account, luxury most Nigerian youths cannot afford.

Each actor—the CBN, the global bank, the platform—makes an individually rational decision to reduce risk. Collectively, however, they produce an irrational outcome: the systemic exclusion of millions of talented Nigerians from the formal global economy.

FALLING BEHIND GLOBAL PEERS

The cost of this failure becomes stark when Nigeria is compared to its peers in the global freelance market. India and the Philippines, two giants of global outsourcing, have successfully integrated their domestic payment rails with global networks.

In India, the Unified Payments Interface (UPI) has increasingly integrated with cross-border rails, allowing freelancers to receive funds with minimal friction. A freelance developer in Bangalore can receive USD, which is converted and settled in Rupees almost instantly, often with the ‘trust’ of the global banking system. Nigeria, by contrast, operates in a silo. Despite having a comparable youth demographic and English proficiency, Nigerian freelancers face a ‘location penalty’ that their Indian counterparts do not. This is not a question of talent, but of infrastructure. As long as the payment rail remains broken, Nigerian talent effectively trades with one hand tied behind its back.

shop the republic

DEVALUING NIGERIAN TALENT

This exclusion does more than restrict cash flow. It actively devalues Nigerian labour. In economics, friction reduces speed. When the mechanism for paying a worker is complicated, that worker becomes less attractive, regardless of their skill. If a US startup must choose between a Polish developer (payable via IBAN) and a Nigerian developer (requiring a complex web of intermediaries), the Nigerian effectively trades at a discount.

Aboyeji confirms this ‘valuation drag’. ‘The friction in cross-border payments does drag on the valuation and attractiveness of Nigerian human capital,’ he explains. ‘Difficulty in payment processes can make Nigerian developers less competitive compared to peers in regions with smoother payment experiences.’

This valuation drag also contributes directly to the japa phenomenon. When digital migration (working remotely for global pay) becomes difficult due to financial friction, physical migration becomes the only viable alternative. By failing to build the rails for digital exports, the system inadvertently encourages the export of the talent itself.

THE REALITY ON THE GROUND

The banking system’s failures have real-world costs. Etoma is aware of this ‘hidden tax’. He recalls quitting his local job after his first major freelance gig paid him $300, a sum that eclipsed his entire year’s salary at the time. ‘I was making way less than where I worked so I just went into it full time,’ he says. But the friction remains. In a recent transaction testing a new payment platform, he estimates losing close to ₦50,000 due to double conversion fees. ‘That is ₦50,000 that vanishes,’ he adds. ‘It’s not a service fee. It’s just gone.’

For Yvonne Ocran, the psychological toll is constant. The choice is often between security (low rates) and liquidity (crypto), with neither offering a structural solution. ‘Fees are frequently passed on to the beneficiary,’ she explains. ‘It is enough to get one frustrated.’

This frustration breeds a defensive mindset. Freelancers hoard foreign currency, refusing to repatriate it into the Nigerian banking system, not just because of the rates, but also due to a fundamental lack of trust that they will be able to access it later. The ‘Central Bank of the Freelancer’ becomes their own digital wallet, completely divorced from the national economy.

STRUCTURAL ARBITRAGE: BUILDING BRIDGES

While regulators debate trust frameworks, the market is already building around them. The emerging solution pivots from fixing the ‘pipe’ in Nigeria to changing the destination. If the global banking system treats Nigerian accounts as high-risk, the workaround is to provide Nigerian freelancers with accounts that possess global signalling. This is the premise behind the new wave of financial service providers entering the market.

Platforms like GrabrFi are solving the ‘last mile’ problem by effectively erasing the geographical penalty. By providing freelancers with US-domiciled bank accounts, they enable UI/UX designers in Nigeria to receive payments via Automated Clearing House (ACH) or Wire Transfer, as if they were local US residents.

Unlike traditional shadow rails, this infrastructure is integrated into the formal system. GrabrFi partners with Regent Bank (Member FDIC), extending the same ‘trust tax’ protection enjoyed by US citizens to Nigerian freelancers. Crucially, unlike traditional domiciliary accounts that often bleed capital through maintenance charges, these accounts typically have no monthly fees, lowering the barrier to entry for micro-freelancers.

For freelancers like Etoma, using GrabrFi affords him the luxury of predictability. When he withdraws funds from his Upwork account into his US account through GrabrFi, the timing is precise, with flexibility for conversion to local currency at competitive rates. ‘If I withdraw around 1:45 a.m., I will receive it at exactly at 2:45 p.m.,’ he explains. ‘No earlier, no later.’

These distinctions—sovereignty and reliability—are critical. The US-domiciled model allows the freelancer to hold the asset in USD. They transition from a passive recipient, begging for inflow, to a global economic entity, shielded from local volatility until the moment they decide to convert for consumption via integrated rails, such as Send by Flutterwave. This mechanism is a form of ‘structural arbitrage’. Instead of capital struggling to navigate the complex, fee-laden correspondent banking route to West Africa, it settles instantly in a US institution. The freelancer then controls the ‘last mile’.

shop the republic

WHERE DO WE GO FROM HERE?

As we look toward 2030, the Nigerian freelance economy stands at a crossroads. The current equilibrium, where billions of dollars flow through shadow rails, is unsustainable for both the regulator and the worker. Three scenarios present themselves.

In the first, the status quo persists. The ‘hidden tax’ remains, and the freelance economy increasingly dollarizes, operating entirely outside the purview of the CBN. This results in a continued loss of tax revenue and data visibility for the state. In the second, regulation strangles innovation. A crackdown on crypto and virtual accounts forces freelancers back into the inefficient formal system, likely stifling the sector’s growth and accelerating physical emigration. The third, and most hopeful scenario, is convergence. Regulators recognize the efficiency of stablecoins and virtual accounts, integrating them into the formal framework. Banks partner with platforms like GrabrFi and Bitnob to offer seamless, low-cost rails. In this future, the ‘location penalty’ disappears.

‘Nigeria’s freelance economy represents one of its most valuable assets—young, globally competitive talent earning hard currency,’ Abiodun concludes. The flight to virtual accounts and stablecoins represents rational economic behaviour in the face of constraints. As the world moves toward a borderless digital workforce, the financial rails must realign. Until they do, the ‘hidden tax’ remains a penalty on ambition that Nigeria can no longer afford to pay⎈

BUY THE MAGAZINE AND/OR THE COVER

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

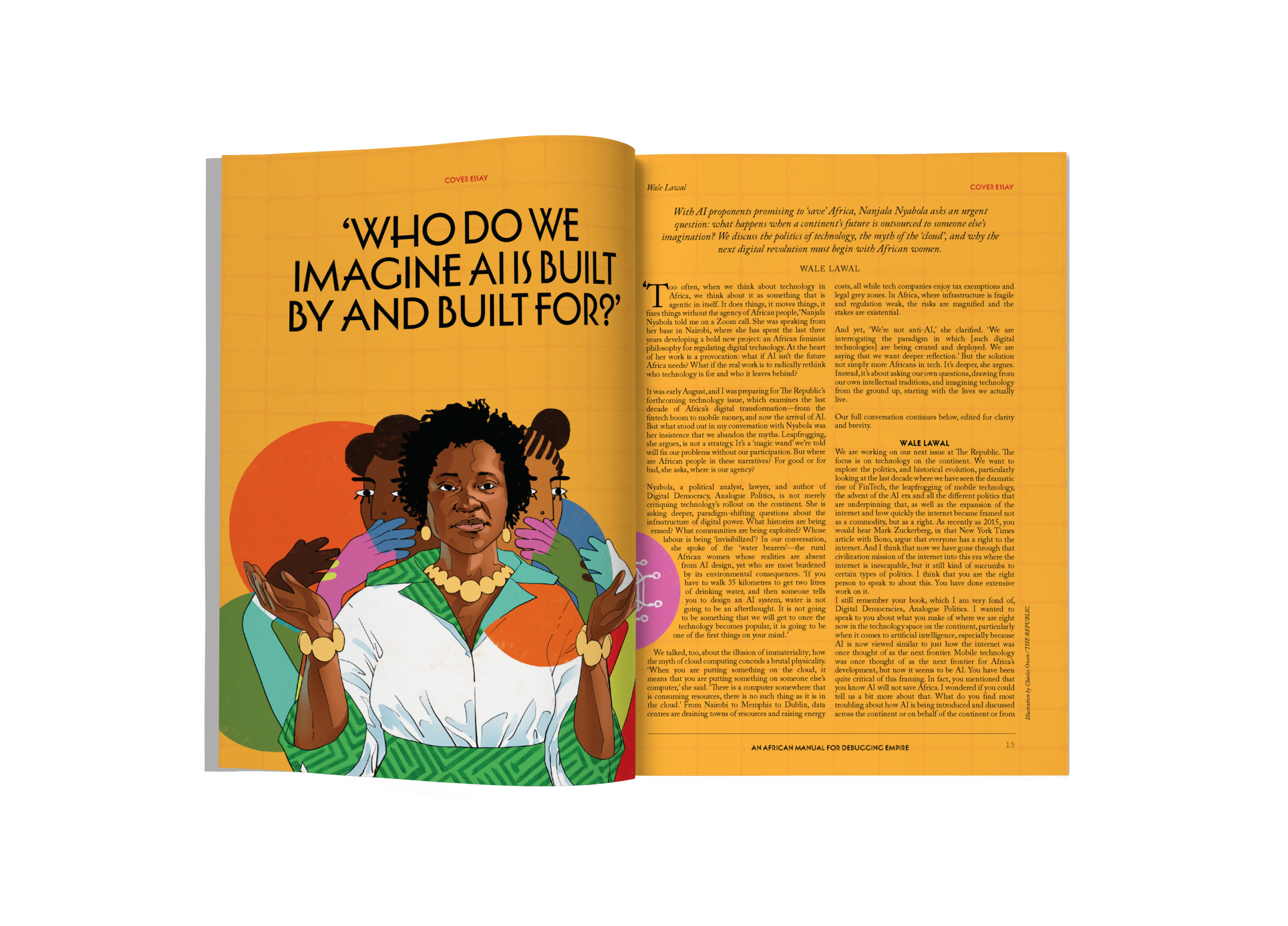

The Republic V9, N3 An African Manual for Debugging Empire

₦40,000.00

US$49.99