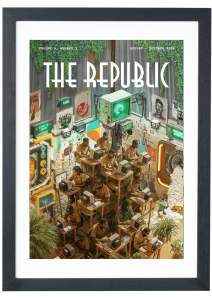

Photo Illustration by Ezinne Osueke / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

The Neo-Colonial Logic of Global Credit Ratings

Photo Illustration by Ezinne Osueke / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

The Neo-Colonial Logic of Global Credit Ratings

In early 2023, Nigeria found itself in the eye of an economic storm as Moody’s—one of the world’s leading credit rating agencies—downgraded Nigeria’s credit rating from B3 to CAA1. This decision sent shockwaves through the financial markets, triggering a cascade of consequences that would reverberate across the nation. As the news broke, investors pulled back, and the value of Nigerian government bonds plummeted, leading to an immediate spike in borrowing costs. The dollar-denominated 2051 Eurobond, for instance, experienced a decrease of more than 2.8 cents, falling to 68.758 cents on the dollar. This decline in bond prices resulted in an increased premium, or ‘spread’, that investors demanded to hold Nigerian debt over US Treasuries, which widened by 46 basis points to 777 basis points. For a country already grappling with high inflation, inadequate infrastructure and a growing debt burden, this downgrade was more than just a number; it was a stark reminder of how external assessments could dictate the economic fate of nations.

As many African countries strive to recover and rebuild in the aftermath of the 2020 COVID-19 pandemic, access to affordable financing has become critical. With international investors increasingly relying on credit ratings to gauge risk, a single downgrade can severely limit a country’s ability to attract investment and secure funding for essential development projects. In Nigeria’s case, the downgrade not only raised borrowing costs but also threatened ongoing efforts to invest in infrastructure and social programmes vital for economic recovery. The strain from higher debt servicing costs would necessitate the reallocation of funds from planned infrastructure and social initiatives to meet debt obligations, thereby hindering economic recovery efforts.

Nigeria’s experience echoes the struggles of other African nations like Ghana and Egypt, where recent downgrades (in February 2022 and October 2023, respectively) have exacerbated economic challenges. The broader context of this issue is the systemic bias inherent in the global financial system. African nations, often burdened by historical legacies of colonialism and neo-colonialism, are frequently subjected to stringent rating criteria that may not fully account for their unique economic realities, which could lead to inaccurate assessments and entrench a cycle of dependency.

Across Africa, there are growing calls for reform within the credit rating industry. Stakeholders are advocating for changes that would lead to more accurate and equitable assessments reflective of local contexts. As economist, Dambisa Moyo, argued in her book Dead Aid, the current model of foreign aid has not only failed to alleviate poverty but has actively hindered Africa’s progress, perpetuating a cycle of dependency and corruption thus highlighting the need for structural changes in how financial assistance is provided.

THE ROLE OF CREDIT RATING AGENCIES

Credit Rating Agencies (CRAs)—Moody’s Investor Service, Standard & Poor’s and Fitch—have become inextricably interwoven into the fabric of the global financial system, offering ratings that help investors assess the creditworthiness of diverse organizations, including sovereign governments and corporations. Their primary function is centred around mitigating information asymmetry between borrowers and lenders by providing standardized credit risk assessments. With the continued rise of financial globalization as well as the integration of CRA ratings into regulatory frameworks such as Basel II, which incorporates these ratings into bank capital requirements, CRAs have gained increased prominence.

CRAs emerged in the mid-nineteenth century, in the United States as a tool to inform investors about the creditworthiness of newly issued securities. Financial analyst, John Moody founded Moody’s in 1909, initially focusing on rating railroad bonds. As financial markets expanded, the scope of CRAs broadened to include various industries and, eventually, sovereign nations. By the late twentieth century, CRAs had become instrumental in assessing the creditworthiness of countries, influencing their access to international capital markets and the cost of borrowing.

Today, credit rating agencies utilize an alphabetical scale (‘AAA’ to ‘D’) with slight variants for each CRA, which were first introduced in 1924, to grade creditworthiness. A higher rating indicates that such obligations are of the highest quality—having minimal risk and corresponding lower interest rates. A lower rating indicates increased risk and higher interest rates. These ratings are important for both investors and borrowers since they not only guide investment decisions but also serve as a standard metric for evaluating credit quality in the market.

Despite their critical role, CRAs have received widespread criticism, particularly in the aftermath of financial catastrophes such as the 2008 global financial crisis. Critics contend that CRAs frequently prioritize profit over factual assessments, resulting in conflicts of interest. For example, during the 2008 financial crisis, numerous institutions obtained high ratings shortly before their collapse, raising concerns about the reliability of these assessments. Furthermore, experts like renowned economist and financial analyst, Nouriel Roubini, have criticized the oligopolistic nature of the CRA industry (dominated by a few major players), leading to calls for increased regulation and oversight to ensure accountability and transparency.

In Africa, the challenges are compounded by factors such as limited data availability and subjective assessments. Many African countries lack comprehensive economic data, which can lead to biased ratings that fail to accurately reflect their economic realities. For instance, GDP measurements exclude the vast informal sector, underestimating actual economic capacity. Debt assessments overly focus on debt-to-GDP ratios rather than revenue mobilization and foreign direct investment (FDI) potential. Commodity price volatility is also overemphasized, ignoring diversification efforts. Thus, high-growth economies like Ethiopia and Rwanda face constrained ratings due to past risks. This subjectivity can result in inflated borrowing costs and hinder development efforts across the continent.

shop the republic

THE IMPACT OF CREDIT RATINGS ON AFRICAN ECONOMIES

The borrowing costs of African nations and their attraction of foreign investments are directly impacted by credit ratings. A credit rating downgrade could trigger a spike in yields on government bonds, making paying off their current debts or funding new initiatives costlier for these countries. Research by the United Nations Development Programme, published in April 2023, indicates that subjective credit ratings have historically resulted in billions in excess interest payments for African countries—estimates suggest losses totalling approximately $75 billion due to inflated borrowing costs attributable to biased assessments. This financial burden restricts governments’ ability to make investments in critical sectors like healthcare, education, and infrastructure, all of which are crucial to attaining long-term, sustainable economic growth and development.

Furthermore, unfavourable ratings can discourage foreign investment by depicting countries as high-risk environments. Investors frequently depend on CRA assessments when deciding where to allocate capital. Hence, a low rating might result in lower FDI, further constraining economic growth. This dynamic generates a vicious cycle in which poor ratings result in increased costs and diminished investment prospects.

The relationship between credit ratings and economic growth is complex but highly significant. Higher credit ratings typically correlate with better economic performance measures like GDP growth and fiscal stability. In contrast, lower ratings could exacerbate economic vulnerabilities by limiting access to affordable financing options. For example, countries such as Nigeria have experienced downgrades, resulting in higher borrowing costs and less budgetary room for development initiatives.

Moreover, data suggests that the methodologies employed by credit rating agencies frequently fail to account for the distinctive economic contexts of African countries. Traditional measures used by CRAs, such as GDP per capita or government debt levels, may not sufficiently indicate a country’s capacity for growth or resilience to external shocks. This kind of oversight can lead to misrepresentations that further entrench economic inequities. For more objective ratings that take into account Africa’s economic realities, CRAs ought to consider economic resilience indicators like revenue diversification and savings rates, debt sustainability metrics such as debt-to-revenue ratios, and external shock absorption capacity via foreign exchange reserves and trade diversification. Governance factors, human capital, and climate resilience should also be integrated for a more accurate risk assessment of developing economies.

The impact of biased credit ratings extends beyond individual countries as it can exacerbate broader economic inequalities within Africa. Countries with lower ratings may struggle more than their higher-rated counterparts during periods of economic turmoil or global financial volatility. As borrowing costs rise and access to capital markets reduces, these governments may be obliged to impose austerity policies that disproportionately affect vulnerable populations.

THE IMF-CRA INTERPLAY: A FOCUS ON KENYA

The reliance of numerous African governments on external credit assessments perpetuates dependence on International Financial Institutions (IFIs), which frequently impose conditions consistent with CRA ratings. These conditions can limit policy autonomy for African governments and prioritize debt repayment over essential social investments. The impact of this is clearly visible in the nexus of influence that the International Monetary Fund (IMF) and CRAs have had on Kenya’s economy.

In April 2021, Kenya secured a $2.34 billion IMF Extended Fund Facility (EFF), conditional on fiscal consolidation and improved governance. Despite this, implementation challenges led to Moody’s downgrading Kenya’s rating from B3 to Caa1 in July 2024, citing difficulties in executing austerity measures after the government’s withdrawal of the highly controversial 2024 Finance Bill. This downgrade restricted access to affordable market-based loans.

However, between both events, in July 2023, the IMF disbursed $606 million under the EFF/ Extended Credit Facility and Resilience and Sustainability Facility, which demonstrated continued institutional support despite market scepticism. By January 2025, Moody’s revised Kenya’s outlook to positive while maintaining the Caa1 rating, acknowledging reduced liquidity risks due to ongoing IMF engagement and reform efforts.

This sequence underscores a dynamic where fluctuations in ratings directly influenced Kenya’s funding ability. The improved outlook signalled a potential easing of liquidity risks and enhanced external financing options due to international institutional support. Yet, Kenya remained constrained by its speculative-grade Caa1 rating (‘junk’ status), which limited access to affordable market-based loans and perpetuated reliance on IMF assistance with its associated conditionality. Critics, including the African Peer Review Mechanism, suggest rating agencies may overstate vulnerabilities in African economies, influencing the terms of financial assistance and perpetuating external financial dependencies.

Thus, while Moody’s revised outlook reflects a recognition of Kenya’s efforts toward economic resilience, the prevailing Caa1 rating continues to pose challenges in accessing affordable financing. This situation underscores the significant influence of CRAs on shaping financial narratives and the conditions imposed by international financial institutions, which often prioritize short-term fiscal adjustments over long-term development needs.

shop the republic

THE INFLUENCE OF COLONIAL AND NEO-COLONIAL LEGACIES

The influence of CRAs in Africa is deeply rooted in colonial legacies. Colonialism in Africa was characterized by resource extraction and the creation of economic structures that favoured the colonizers. European colonialists designed systems that relegated African countries to the role of raw material suppliers for their industries. Historian Dr. Walter Rodney argued that this strategy was exploitative and fragmented local economies, hindering the development of self-sustaining industries. For instance, colonial policies often forced African countries to prioritize cash crops for export over food production for local consumption, leading to persistent food insecurity.

The introduction of foreign economic systems disrupted traditional trade patterns and local markets, as colonial officials established new marketing centres to serve their interests, effectively pulling down indigenous trading systems. This reorganization led to a dependence on imported goods and the systematic dismantling of local production capabilities. Historical analyses indicate that this created monocultural economies heavily reliant on external markets, a trend that has persisted into the post-colonial era.

Colonial policies also involved the expropriation of land from indigenous populations, as seen with the Native Land Act in South Africa. This disenfranchisement has had lasting impacts on land ownership and economic opportunities. Although colonialists invested in infrastructure like railroads, these developments primarily served their interests by facilitating resource movement rather than boosting local economies. Many African nations, eager to bridge their infrastructure deficits, have resorted to borrowing. However, this often leads to a vicious cycle of debt dependency. Short-term projects with limited long-term sustainability and the heavy burden of debt servicing divert resources from critical sectors like healthcare and education, hindering sustainable economic growth and exacerbating inequality.

Despite this, the end of formal colonialism did not signify the end of external control; rather, it marked the beginning of neo-colonialism, which is defined by indirect subjugation through economic methods. Neo-colonialism takes many forms, including foreign aid, the influence of multinational enterprises, and international financial institutions such as the IMF and the World Bank. These IFIs frequently set conditions that prioritize debt repayment over domestic development requirements, reinforcing dependency. Many African states are locked in debt cycles as a result of loans from international financial institutions with onerous terms. These conditions usually necessitate austerity policies that lower public spending on key services such as healthcare and education, exacerbating poverty and constraining economic growth.

Neo-colonialism is also evident in the dynamics of foreign aid and investment. Aid often comes with conditions that favour donor countries’ interests rather than addressing the structural issues facing recipient nations. The reliance on foreign aid can also create a form of dependency that stifles local initiative and governance. Furthermore, multinational corporations often exploit Africa’s vast natural resources while repatriating profits back to their home countries. This extraction model ensures that wealth generated from Africa’s resources does not circulate within local economies but instead contributes to the prosperity of foreign nations. The imbalance created by these practices highlights how neo-colonial dynamics continue to shape Africa’s economic landscape.

Understanding this historical context is significant as CRAs often operate within frameworks rooted in colonial legacies. Ratings by agencies such as Fitch and Moody’s often reflect historical judgements, which are generally biased against African economies. This tendency can result in inflated risk estimates, stifling economic growth, and entrenching a cycle of dependency. CRAs can award unjustly low ratings by applying Western economic models that fail to account for the unique obstacles that African countries face, raising borrowing costs and limiting access to credit.

COLONIAL AND NEO-COLONIAL INFLUENCES IN WEST AFRICA

Nigeria’s interactions with CRAs and IFIs exemplify the intricate relationship between colonial legacies, neo-colonial influences, and modern economic challenges. In January 2023, Moody’s downgraded Nigeria’s credit rating from B3 to Caa1, citing extensive fiscal pressures and institutional weaknesses. Economist Dr. Ayo Teriba criticized this downgrade, arguing that it overlooked Nigeria’s efforts to stabilize its economy amidst significant challenges. He believes such ratings perpetuate negative views of African economies without recognizing positive developments or local contexts. This downgrade had immediate effects, causing a sharp decline in Nigerian government bond values and increasing borrowing costs. The Nigerian government also disputed this assessment, claiming it did not adequately reflect ongoing economic stabilization efforts or the unique socio-economic challenges the country faces.

This situation underscores a broader critique that CRAs often use standardized metrics that fail to consider local contexts, perpetuating negative perceptions of African economies. Scholars argue that these assessments often reflect neo-colonial attitudes, prioritizing data that aligns with Western perspectives while ignoring positive economic indicators within African countries.

The impact of these ratings is further complicated by Nigeria’s recent dealings with the World Bank. In December 2023, Nigeria secured a $1.5 billion loan from the World Bank to support fiscal reforms. While this loan provides essential financial support, it comes with conditions influenced by CRA evaluations. These conditions included unifying multiple exchange rates into a single market-determined official rate and significantly adjusting petrol prices to gradually eliminate a costly, regressive, and opaque subsidy.

The World Bank’s conditions often align with CRA metrics, creating a cycle where external assessments shape both the country’s credit rating and its access to international finance. The conditions imposed by the World Bank, influenced by CRA evaluations, can limit Nigeria’s policy autonomy and prioritize debt repayment over essential social investments. This situation reflects neo-colonial power structures, where external entities exert significant control over national economic narratives and policy decisions.

Nigeria’s experience highlights the persistence of colonial economic structures. The country’s continued reliance on oil exports, a legacy of colonial resource extraction patterns, makes it particularly vulnerable to external economic shocks and CRA assessments that may not fully capture the complexities of its economy.

Ghana’s case further illustrates the challenges faced by African nations in navigating the global financial system shaped by colonial and neo-colonial influences. In 2023, Ghana faced multiple downgrades from all three major CRAs due to rising government financing needs and challenges in managing its Eurobond terms. These downgrades occurred despite Ghana implementing measures to improve fiscal discipline and enhance revenue generation. Ghanaian officials argued that these assessments failed to consider recent economic reforms aimed at stabilizing the economy post-COVID-19. This highlights a critical limitation of CRAs: their methodologies often prioritize short-term indicators while neglecting long-term growth strategies employed by governments.

The implications of these downgrades extend beyond immediate financial impacts. They increase borrowing costs for Ghanaian bonds and deter foreign investment, exacerbating existing economic inequalities. This situation reflects the broader issue of how CRA assessments can reinforce neo-colonial economic structures by limiting access to affordable financing for African nations.

Ghana’s experience with IFIs mirrors that of Nigeria. The country’s engagement with the IMF for financial support has been accompanied by conditionalities that align closely with CRA evaluations. These conditions often require fiscal austerity measures that can limit the government’s ability to invest in critical social and economic development programmes, perpetuating a cycle of dependency on external financial support.

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page

shop the republic

A CALL FOR REFORMS IN CREDIT RATING AGENCIES

African nations face systemic biases in global credit rating practices. Recognizing this, there is a growing consensus among policymakers and economists on the need for reform. Establishing independent, regional credit rating agencies is seen as a transformative step toward ensuring objectivity and fairness in credit assessments. These agencies, rooted in local contexts, could offer a more nuanced understanding of African economies, as emphasized by former South African finance minister, Tito Mboweni, who advocated for rating agencies ‘that understand our context.’ Such institutions would not only foster competition within the CRA industry but also strengthen Africa’s economic sovereignty.

Moreover, creating an African credit rating agency, as endorsed by the African Union, would enhance the accuracy of assessments by incorporating region-specific data and economic insights. Complementing this initiative, African countries must prioritize robust data collection, governance transparency, and institutional strengthening to engage effectively with both local and international CRAs. These reforms aim to challenge neo-colonial structures while enabling sustainable development across the continent.

Ultimately, credit rating reform is a crucial component of Africa’s journey towards financial resilience and economic sovereignty. By promoting accurate and fair credit evaluations, African nations can improve their standing in global finance, fostering sustainable economic growth for future generations⎈

BUY THE MAGAZINE AND/OR THE COVER

-

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page