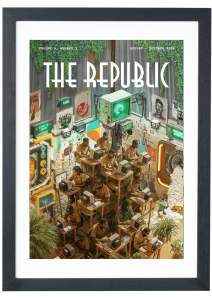

Illustration by Shalom Ojo / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

Saving Nigeria, the Piggyvest Way

Illustration by Shalom Ojo / THE REPUBLIC.

THE MINISTRY OF BUSINESS X THE ECONOMY

Saving Nigeria, the Piggyvest Way

On the last day of 2015, a Nigerian woman posted a tweet that quickly went viral. She had saved ₦1,000 every day that year in a kolo—the much less glamorous Nigerian version of a piggybank—accumulating ₦365,000 (about $1,800 at the time). Telling me this story, Joshua ‘Josh’ Chibueze, who would go on to become a co-founder and the chief marketing officer of Piggyvest, didn’t just admire her discipline; he spotted an opportunity. Young Nigerians were clearly struggling with savings, turning to wooden boxes instead of financial institutions, and here was a habit that could be digitized.

On 1 January 2016, Chibueze tweeted, ‘It’s only natural to think about an online solution for this piggybank idea, but then you have to really understand how Nigerians think.’ In response, his soon-to-be co-founder, Odunayo ‘Odun’ Eweniyi suggested that the idea could take the shape of an e-wallet. The discussion shifted offline, where it expanded to include five other members of the would-be Piggyvest founding team: Somtochukwu ‘Somto’ Ifezue, Ayo Akinola, Ibukun Akinola, Terry Kanu, and Nonso Eagle. One key realization fuelled the team’s decision to go ahead with creating the product: Nigerians purchased kolos, only to break them when they needed to retrieve their funds. This meant that Nigerians were willing to spend to save, and the idea of charging a breaking fee for withdrawals outside of set dates could work, thus rendering the idea a profitable one.

By 7 January 2016, the first iteration of their digital savings product, Piggybank.ng, was ready. However, for the model to work—relying on users setting aside money at regular intervals—they needed a reliable automated payments system. Enter Paystack, a payment gateway that had just kicked off its public beta phase that same month. The beta version of Piggybank.ng was taken down shortly after its initial release, and in its absence, Paystack formally launched. By April 2016, the full Piggybank.ng platform went live, powered by Paystack’s payment infrastructure. And by the end of the same year, they had helped about 700 users save ₦21 million.

Three years later, the Piggybank.ng founding team expanded their product offerings by incorporating an investment service, and thus, in April 2019, Piggybank.ng became Piggyvest. Today, the company, with over five million users, is helping Nigerians reach their savings goals and attain financial security. Piggyvest has seen enormous success, delivering a cumulative payout of over ₦2.8 trillion ($1.8 billion) by the first half of 2025 and securing a spot on CNBC’s list of the world’s top fintech companies for two years in a row.

A COVENANT CONNECTION

While the company started with a tweet, the true Piggyvest origin story traces back to Ota, Ogun State. The small industrial town, about 40 kilometres from Lagos, serves as the base of Covenant University (CU), a leading tertiary institution in Nigeria where all seven of the Piggyvest founding team studied between 2006 and 2013.

Chibueze and Ayo Akinola bagged their degrees in Computer Science in 2012; Eweniyi earned her degree in Computer Engineering in 2013; Ifezue and Kanu completed their degrees in Mechanical Engineering in the same year; Eagle in Civil Engineering; and Ibukun had finished earlier, bagging her Accounting degree in 2010.

CU, known for its disciplined culture and mission to raise ‘Kings and Queens in Hebron’, has the reputation of being a breeding ground for some of Nigeria’s most successful startup founders. It was within this environment that Chibueze, Ifezue and others began exchanging ideas that extended beyond the lecture hall. ‘When we were there, we didn’t really like it that much, but when we got out, we started to see the benefits. They constantly told us that they were raising a new generation of leaders and so we did start to see ourselves as leaders,’ Chibueze told me in a virtual interview.

And thus, it was this deeply ingrained leadership mindset that gave them the audacity to launch their own startups almost straight out of the university. First came ParolZ in 2012, a discount and loyalty platform Ayo Akinola, Ifezue and Chibueze co-founded. The following year, Ifezue brought in Ayo’s sister, Ibukun, after her return from her Master’s programme in the UK. Eweniyi also joined the team in 2013 after a chance encounter with Ifezue in their estate in Ogba, Lagos. She was on her way back from a regretful job interview when Ifezue leaned out of his home window and convinced her to join what he and a few other CU alumni were building.

Then came CVFlash in January 2014, a service Ifezue developed to help job seekers create hire-worthy CVs—a skill that was apparently very lacking in the job market at the time. He called on Eweniyi to help write some CVs, effectively making her the co-founder. By February of the same year, CVFlash had become PushCV, a startup that not only wrote CVs but also screened applicants and sent the best candidates to employers. For PushCV to reach its full potential, Ifezue and Eweniyi brought in Chibueze, Kanu, Nonso and the Akinola siblings on board as co-founders.

PushCV’s curated screening gave it an edge over other local job boards like Jobberman. By August 2014, they had secured a $25,000 investment and office space in Yaba from the Leadpath Accelerator Program run by Olumide Soyombo, an early-stage tech investor whose mentorship would prove pivotal to the team in the years to come. And by the end of 2015, the company had become profitable, primarily based on the fees they charged companies per successful recruit. Sometime after starting Piggybank.ng, the team also launched 500dishes (a niche food delivery service) and 99Staff (a remote work outsourcing startup).

In essence, the Piggyvest founding team were in the business of providing solutions to Nigerian millennials’ problems: everything from unemployment to the need for quality food at their doorstep. And so, when another Nigerian millennial problem—a struggling savings culture—surfaced, it felt natural to position themselves as solution providers to that too.

BUILDING AGAINST THE ODDS

Over the past nine years, Piggyvest has experienced remarkable growth, a feat its chief operating officer, Eweniyi, mostly attributes to the company’s ‘customer-obsessed’ philosophy, which shapes everything from thoughtful communication to products that cater directly to customers’ anticipated needs. ‘We believe evolution is really about staying ahead of our users and the changing technologies without losing our core,’ Eweniyi told me.

Consequently, the company has frequently expanded its product offerings. The maiden version of the app only had the Piggybank product that allowed regular automated savings, with penalty-free withdrawals once a quarter. In 2017, they launched the ‘Safelock’ product, their twist on fixed deposits that allows users to receive their interest upfront. 2019 ushered in four landmark products: ‘Investify’, which marked the Piggybank.ng-to-Piggyvest transition; Flex Naira, which serves as emergency funds since penalty-free withdrawals could be made at any time; Flex Dollar, which allows users to save in dollars and hedge against the Naira devaluation; and the target savings product, which has helped users save for everything from vacation to cars. The team built on the success of the target savings product by launching the tailored ‘House Money’ feature in 2024.

Ifezue, Piggyvest’s chief executive officer, laid out the path from product ideation launch:

First, we map a concept that aligns with our vision & mission, especially in the sense that it enables customers have a better grip, oversight and sense of their finances. Then, we ask a lot of customers about the problem. This helps us determine if it’s worth solving and once we know this for sure, we begin development and shipping.

Piggyvest users earn between 12 per cent and 22 per cent interest on naira savings plans and seven per cent on Flex Dollar, as the fintech invests users’ dollar funds in low-risk assets like bonds, treasury bills and commercial papers. Lower overhead costs than traditional banks allow Piggyvest to pass on more returns to customers. (On average, Nigerian banks offer savings interest of about 8 per cent, and compete with fintechs, which offer up to 30 per cent interest.) For Piggyvest, as Eweniyi explained at a 2024 OpenHouse event, this is because Piggyvest is more focused on capital preservation—return of capital over return on capital—unlike platforms that use loans to subsidize high savings interests. Instead, Piggyvest’s goal is to maintain sustainable interest rates that cushion both short- and medium-term effects.

Meanwhile, the Investify feature caters to users who are more risk-tolerant, as it offers up to 35 per cent returns. Customers can buy corporate debt notes and real estate shares for as little as ₦5,000 per unit. To broaden its reach, the Piggyvest founding team created PiggyTech Global Holdings, the parent company of Piggyvest, PocketApp (a mobile money wallet) and Piggyvest Business (formerly Patronize). Originally ‘Abeg’, PocketApp was founded in 2020 by Dare Adekoya, Muheez Akanni, Patricia Adoga and Eniola Ajayi-Bembe as a Nigerian version of CashApp. The following year, Abeg was acquired by PiggyTech who footed a $2 million headline sponsorship bill for the sixth season of Big Brother Naija, Nigeria’s most popular reality show. The sponsorship paid off as the platform’s user base grew from 20,000 to over 1.8 million after the show, a 7,000 per cent increase. Consequently, the company took on the sponsorship again in 2022, but this time under the name ‘PocketApp by Piggyvest’.

Piggyvest Business initially launched as Patronize to help businesses process payments smoothly, through smart POS devices called Pay Points, but has presently evolved into a full business banking solution.

Despite the company’s immense growth, Piggyvest still maintains a lean team with a staff-to-customer ratio of about 1:30,000, a lesson the founding team learnt from their previous ventures. At the time the idea for Piggyvest came, PushCV was already running out of funds as they had made the mistake of over-hiring. Consequently, the founding team decided to be more careful with managing Piggyvest’s resources from the jump, even denying themselves salaries in the early days. ‘We’ve not raised more than $5 million in venture funding, unlike some of our counterparts, so we’ve had to keep our burn rate low. This is something our mentor, Mr Olumide Soyombo, had repeatedly advised us to do,’ Chibueze said.

Despite its relatively small size, the Piggyvest team is a powerhouse. Eweniyi credits this to the company’s formidable work culture. ‘We hire people who align with our values and understand why we exist and why we do what we do,’ she shared. She also believes the company culture of respect, directness and humanity seamlessly pours into customer relations. ‘We, as a leadership team, are also never afraid to course correct and admit that we were wrong about something. And so, that shows in the way we relate with customers as well,’ Eweniyi added.

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00

NAVIGATING NIGERIA’S REGULATORY MAZE

Piggyvest has so far avoided clampdowns from regulatory bodies like the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC), a major triumph considering how stringent these regulators have been—especially with fintechs—over the years. For instance, in January 2025, the SEC issued an alert against Risevest for operating illegally as a digital dollar/fund manager. According to tech journalist Udoh Charles, this was part of a recent trend of fintechs skirting licensing requirements by registering as cooperative societies rather than securing a proper fund manager license. Even back in 2021, the CBN froze the accounts of Chaka, Bamboo, Risevest and Trove, accusing the platforms of operating without the proper asset management license, only to reverse course two years later without explanation.

When Piggyvest launched in 2016, the team had little clarity on how to navigate the country’s regulatory maze. They began with a cooperative license, soon followed by a microfinance bank license—neither of which perfectly aligned their operations, since the company neither ran group savings schemes nor issued loans. To better align with their services, they also secured a Mobile Money Operator (MMO) license, allowing them to store and transfer funds. For their investment service, Piggyvest initially partnered with AIICO Capital, a licensed Nigerian fund manager. It wasn’t until 2023, according to TechCabal, that the company obtained its own SEC-issued fund manager license through an affiliate, PV Capital.

For Piggyvest, the key to staying compliant is having multiple contingency plans—not just a plan B, but a plan B through E. But these plans don’t come cheap. For instance, to acquire an MMO license alone, the CBN requires a minimum share capital of ₦2 billion and a ₦2 billion escrow deposit. This is why funding is so essential to fintechs’ operation and growth. Accordingly, in 2018, after Piggyvest received $1.1 million seed funding from the trio of Soyombo’s LeadPath Nigeria, Village Capital and Ventures Platform, they announced that they would use the funds for ‘license acquisition and product development’.

Nonetheless, Chibueze remarks that regulators have improved, noting that fintechs initially had to navigate by trial and error because the frameworks for their products simply didn’t exist. But now, ‘whatever it is you’re trying to introduce to the market, there’s something for you.’ He added, ‘There’s been a shift, especially with the likes of Opay having over 40 million customers. They’re paying a lot more attention to digital platforms now.’ Still, Eweniyi posits that there’s room for improvement: ‘I hope we can get better regulation that protects the users while allowing companies to build creatively. We tend to overregulate too early, and innovation gets stifled.’

THE BUSINESS OF TRUST

Over the years, Piggyvest has managed to build a customer base that’s not just loyal to the business but also committed to spreading its gospel. Word-of-mouth has arguably been the company’s biggest growth tool, as users often enthusiastically share, both online and offline, how using the app has changed their lives. In the early days, this was largely motivated by the N1,000 referral reward users and their referees received when they got someone to sign up. For Shallom Adelaja, a 27-year-old digital marketing strategist, this was how her Piggyvest journey began in 2019; but it wasn’t until 2022 that she started using the app religiously. ‘I didn’t know how to go about saving in dollars or investing on my own, but I tried it on Piggyvest because I had come to trust them, and I was amazed at the results,’ Adelaja told me.

But even without the referral reward programme, which ended in 2021, Piggyvest has drawn people in droves. While studying at the UK’s Warwick University in 2020, Joy Edegware, now a 26-year-old management consultant, started using the app after seeing an X user gush about their Flex Dollar feature, which allows users to save in US dollars. ‘In 2023, it was the dollar savings I had built with Piggyvest that tided me over for the few months I was out of a job, especially given the Naira devaluation at the time,’ Edegware remarked.

While Piggybank.ng was initially targeted at Nigerian millennials, it also became the introduction to savings for many Gen Z’s. Inyang Okon, a 25-year-old project manager, started using the platform as a university student, to become more financially responsible with her allowance. ‘Since I started using the app in 2018, I’ve always deducted a portion of whatever money comes into my account to save on Piggyvest, so it imbibed in me a save-first mentality,’ Okon recalled.

The average Piggyvest user’s trust in the company is so strong that even when a technical issue caused a glitch in users’ reflected wallet balances on 1 June, 2025, users expressed unshaken confidence that the situation would be resolved. Okon added, ‘When it happened that morning, my first instinct was to check on Twitter [X] to see if I was the only one and when I realized I wasn’t, I figured it was a glitch. I didn’t panic at all because I trusted them.’ By afternoon, the company had made an X post announcing that they had rectified the issue and apologizing for the inconvenience it caused.

Chibueze credits the trust to constant, sincere communication, both in marketing and within the product itself. ‘You open the app, and you can see your interest growing. If you put ₦20,000 in Piggyvest today, you can predict exactly what you’ll get back after a set period. That predictability builds trust,’ Chibueze asserted. On the tech side, the product is solid, but the few times when there are hiccups, the technical teams are quick to proffer a solution while the excellent customer service team holds down the fort.

Moreso, such thoughtful communication yields clear results. On 1 August 2025, after notifying users that ₦150 million was paid in Safelock interest on 31 July alone, Piggyvest had a record single-day inflow of ₦7 billion. ‘People have this money in their banks or other financial institutions, but if you get your communication right, they’ll give it to you. We are in the business of trust; we’re constantly thinking of how we can get more people to trust us with their money,’ Chibueze noted.

It was this understanding that informed Piggyvest’s decision to launch a dedicated Content department in 2021, under the leadership of Daniel Orubo. Fresh out of his editor-in-chief role at Zikoko, Orubo was tasked with producing content that fuelled real growth. Consequently, he and his so-called ‘creative collective’ launched the Piggyvest blog, where they published innovative story series like ‘My Money Mistake’ and ‘Women and Money’. It’s not in every financial institution that you can say you’re hired as a Cartoonist & Writer, but that was the role Agnes Ekanem filled when she helped to create the Grown Ups comic series, a form of financial edutainment. The team took it a step further by launching the premier Piggyvest Savings Report in October 2023, a comprehensive breakdown of Nigerians’ savings and spending habits. Consequently, the hundreds of thousands of clicks converted, growing Piggyvest’s customer base to its current size. But beyond that, according to the company, the savings reports have become a reference point for many business owners and decision makers in Nigeria.

shop the republic

BRIDGING THE TRUST DIVIDE

In Nigeria’s low-trust society, the level of customer confidence Piggyvest has been able to build is noteworthy. Before Piggyvest came along, Nigerians were mostly turning to kolos, cooperatives or savings circles (‘Ajo’ in Yoruba or ‘Esusu’ in Igbo) for their savings needs. According to Funmi Okubanjo, a development finance analyst and the executive director of The Aziza Development Foundation, the latter two worked because they relied heavily on trust. ‘You’d save with people you had at least established a relationship with, whether around trade lines, professions, or even religion—your church, for instance,’ Okubanjo explained.

In any case, people could put a face to their money. However, when Piggyvest came, there was no face, only a screen. Okubanjo believes this was not a hindrance to the younger generation, since millennials were already freely interacting with, and even dating, strangers online. But for the older generation, especially the low-income women her foundation seeks to empower financially, screens don’t cut it. ‘From my experience on the field, they still don’t trust platforms like that. And a lot of the trust issues also come from the back in the 1990s when banks frequently vanished overnight.’

In a bid to put a face to the money, in 2019, Piggyvest launched OpenHouse, an event where customers can come and physically interact with the Piggyvest team—including the founders. So far, the event has happened in four major cities in Nigeria, with plans to expand. ‘A major problem affecting digital platforms is that we don’t have physical branches like banks,’ Chibueze said. ‘We know there’s still a lot more to do to win more of the public’s trust, but we think the OpenHouses are a good starting touchpoint for users.’ Still, Okubanjo highlighted that Nigeria’s low internet penetration rate locks many citizens out of the digital economy. ‘Don’t just think of Lagos; that’s a small proportion of the entire population. Think of the woman in Katsina, who, even if she manages to get a smartphone, buying a data subscription is probably the last thing on her mind. She may only come online once a month so she can’t think of saving regularly on an app.’ Consequently, Okubanjo asserts that if digital platforms like Piggyvest truly want to rope in such a demographic, they need to adopt a hybrid model, whereby users can physically interact with agents in addition to the digital services.

shop the republic

THE NEXT FRONTIER

To many Nigerians, Piggyvest’s journey has been nothing short of awe-inspiring and, as its 10th anniversary approaches, the company seems poised for even further growth. On the product side, the company is gearing up to launch new features in the second half of 2025, including Flex Dollar virtual US account numbers and a Safelock Dollar product. The virtual US account numbers will allow for direct dollar transfers to users’ Flex Dollar wallets, while the Safelock Dollar product will enable users to stow away dollars for a fixed period of time.

Looking further ahead, Piggyvest is hoping to fill a critical gap in Nigeria’s financial ecosystem by launching a product that helps people budget and manage their finances better. As Chibueze explained to me,

Your bank cannot tell you how much you spent on laundry or groceries in the last three months. People resort to interesting ways of figuring these things out themselves, creating Excel spreadsheets just to try and track where their money is going. But we want to answer this question directly. A lot of our users tend to oversave and then run to the app later to break their savings lock after exhausting their funds for the month. On the business end, it means we get to earn more revenue from penalty fees, but it’s still a problem we want to fix for our users. Yes, we’re helping you save and invest, but how can we help you manage your money even better?

While on the surface, building such a product presents the risk of cutting Piggyvest’s revenues, Chibueze insists that it will have the opposite effect, as it will further boost customers’ trust in the company. ‘When you can create value for customers like no other company does, they’ll trust you the most, and that trust translates to increased patronage,’ Chibueze said. This is another pointer to Piggyvest’s commitment to remaining at the intersection of impact and profit.

Expansion is also on the horizon. In the recent past, Piggyvest had expressed interest in expanding to countries with similar macroeconomic conditions to Nigeria’s—like Thailand for instance—as opposed to the expected intracontinental expansion. However, as Eweniyi revealed to me, the company is now eyeing expansion to countries with large Nigerian diaspora communities, given the rising Japa (brain drain) wave. ‘We’ve struck a balance in our outlook now. We’re considering markets that have similar macros but also large Nigerian diaspora connections—countries like Canada, South Africa and even some European countries,’ Eweniyi shared.

While Nigeria’s increasing emigration rate presents opportunities for Piggyvest’s expansion plans, Eweniyi fears that it may not bode well for the local talent pool. She explained that:

The Nigerian fintech industry has some of the brightest minds that I’ve ever seen. But we’re losing them to exhaustion, economic challenges and so on—essentially, the underlying reasons for Japa. People have always left their countries, but it’s happening so much in Nigeria now because so many Nigerians cannot see a clear path from A to success, so they’d like to go somewhere where they can see clearer. We still have a lot of smart people in Nigeria, but so many of them are one leg in, one leg out, meaning they’ll leave the country as soon as they get the opportunity to. But what happens when we no longer have smart people to pick from?

Still, Eweniyi believes that ‘there is magic being worked’ in the local industry. Nigerian fintechs are already building products that provide brilliant solutions to African problems, but the solutions need to become global in nature for the local industry to be elevated on the global stage. ‘My hope is that we’re able to realize that very lofty ambition, and also that we have regulations that foster creativity while still protecting users,’ Eweniyi said.

For Ifezue, the future of the Nigerian fintech industry looks like what he calls ‘embedded finance’. He projects that payments and savings will be woven into ‘the everyday platforms where people already earn, spend and live their lives.’ For instance, food delivery startup Chowdeck and grocery delivery startup GoLemon recently integrated wallet features wherein users have already started saving money for food and groceries. But to take it a step further, Ifezue envisions systems whereby money can be directly deducted from users’ income and set aside for various savings needs, thereby removing the willpower barrier to financial discipline. He added: ‘For small businesses, this will also be transformative. A merchant could automatically set aside tax obligations or build a 30-day cash buffer with every sale.’ To better position themselves for such a transition, Piggyvest is fully launching Piggyvest Business as a subsidiary that will offer bundles like wallet-as-a-service and treasury-as-a-service integrated in an API to interested companies. He said:

But alongside these opportunities, there are serious challenges. Reliability remains a big one. If payments fail or settlements are delayed, trust collapses very quickly. Fraud and social engineering are another concern; the more seamless the flow, the more vulnerable users can be. Regulatory clarity will also be key, especially with open banking, data privacy, and consumer protection.

My overall thesis, however, is that if we get this right, embedded finance becomes the operating system of daily life in Nigeria. People won’t need to think about moving money or setting money aside. It will happen by design, with consent, transparency, and reliability. For individuals, this means effortless consistency in their savings and resilience against shocks. For SMEs, it means healthier cashflow and fewer unpleasant surprises. And for the ecosystem as a whole, it means lower costs, stronger rails, and true financial inclusion. That’s the future I’m betting on: payments and savings that are invisible but dependable and embedded everywhere the customer already is.

For many users, Piggyvest’s growth story, especially against the backdrop of Nigeria’s volatile economy, has also been their growth story. ‘My Piggyvest W.A.E.C score has steadily grown from C to B and now, I’m gunning for an A at the end of the year,’ Edegware told me, referring to the Wealth Accrued & Expanded Consistently (W.A.E.C) results that Piggyvest introduced in 2019 to help users assess their relationship with money. Users can score between A1 and F9—similar to the eponymous West African Examination Council (WAEC) secondary school board examination—depending on how well they saved and invested on the app over the year. Faced with a local currency that has lost a tenth of its value against the dollar in the time Piggyvest has been around, few Nigerians can claim to have a source of personalized monetary stability let alone protection. And perhaps it is here that Piggyvest truly shines. ‘It’s quite easy to lose that touch as companies expand and costs rise,’ Edegware cautioned when I asked her about the future and what, as a customer, she hoped the next 10 years of Piggyvest could look like. ‘Customer care units get downgraded or replaced with AI, but that personal connection is one of their key selling points,’ she emphasized. As the company steps into its tenth year, launching new products and preparing to compete more directly with international fintech players, the trust and loyalty it has built at home may very well be its greatest strength⎈

This essay was produced with support from Piggyvest. The Republic retains full editorial independence.

BUY THE MAGAZINE AND/OR THE COVER

-

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

The Republic V9, N2 Who Dey Fear Donald Trump? / Africa In The Era Of Multipolarity

₦40,000.00