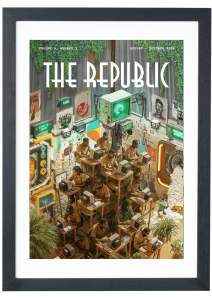

Collage by THE REPUBLIC. Nigerian Constitutional Conference, Lancaster House, London, 1957. / WIKIMEDIA. Other photos: SMITHSONIAN EDU.

THE MINISTRY OF POLITICAL AFFAIRS

How To Wean Nigeria Off The ‘Feeding-Bottle’ Federalism

Collage by THE REPUBLIC. Nigerian Constitutional Conference, Lancaster House, London, 1957. / WIKIMEDIA. Other photos: SMITHSONIAN EDU.

THE MINISTRY OF POLITICAL AFFAIRS.

How To Wean Nigeria Off The ‘Feeding-Bottle’ Federalism

It was fine weather on 23 May 1957, when several Nigerian independence leaders held the first of two constitutional conferences at the Lancaster House, London. A meeting presided over by the British colonial secretary, Alan Lennox-Boyd, the session was attended by the premiers of the northern, eastern and western regions: Abubakar Tafawa Balewa of the Northern People’s Congress, Nnamdi Azikiwe of the National Council of Nigeria and the Cameroons and Obafemi Awolowo of the Action Group. Other delegates to the event were Sir James Robertson, the colonial governor-general and Eyo Ita of the National Independence Party. In addition, were the chiefs of the Northern Region: Sir Muhammadu Sanusi, the Emir of Kano and Alhaji Usman Nagogo, the Emir of Katsina. Also in attendance were chiefs of the Eastern Region: HRH Eze Johnson Osuji Njemanze, the paramount ruler of Owerri, Chief Nyong Essien, the paramount ruler of Uyo and Chief S. E. Onukogu, the Eze of Imo. The delegate also included chiefs of the Western Region, Sir Adesoji Aderemi, the Ooni of Ife and Oba Daniel Aladesanmi II, the Ewi of Ado-Ekiti.

The agenda of the 1957 Lancaster House conference traced back to the Ibadan General Constitutional Conference of 9 January 1950, where the idea of a federal system of government among the three Nigerian regions originally emerged. There, under the British colonial governorship of John-Stuart Macpherson, it was resolved that the northern, eastern and western regions should become administrative regions with a governor each and a House of Assembly; that Lagos should be the seat of the autonomous municipality of the Federal Government Territory administered with the task of monitoring the affairs of the three regions; and that revenue from tax should be allocated to the three regions based on a per capita basis. The Ibadan Conference of 1950 was followed up with the London Constitutional Conference of 27 July 1953, which firmly recommended a Nigerian federation and internal self-governance amongst its regions. Yet it was at the final Lancaster House conference of 29 September 1958 that Lennox-Boyd fixed the date for Nigeria’s independence. Following that, the second reading of the Independence Bill for a federal Nigeria was debated at the House of Commons on 15 July 1960 and the independence constitution came into force on 1 October 1960.

The 1963 Constitution would go on to abolish the legal rights of the British monarchy in Nigeria by establishing the Federal Republic of Nigeria. It did this by vesting the president with the powers of the head of state and inaugurating a political system anchored on the Westminster parliamentary system of government, where the president is elected through a secret ballot of the party members of both houses of the federal parliament. Meanwhile, Section 157 (1) of the constitution deemed Nnamdi Azikiwe to be the ‘elected’ president of Nigeria at the commencement of the constitution after the British Queen was formally removed as the head of state.

The first Nigerian republic ended on 15 January 1966 following the military coup d’état led by Major Chukwuma Kaduna Nzeogwu; the second republic of 1979, through its constitution, abandoned Here, the federation comprised 19 states and a federal capital territory. The executive powers of the Federal Republic of Nigeria were vested in the president who was considered to have been elected to such office by at least one-quarter of the votes cast in each of at least two-thirds of all the states in the federation, unlike the secret parliamentary ballot election of the 1963 constitution.

The 1993 constitution created the third ‘Nigerian Republic’—that is, the third period of civilian internal self-governance, through its constitution, which was drafted by the General Ibrahim Badamosi Babangida military dictatorship in 1989. The constitution also favoured an American-styled presidential system hinged on two political parties: the centre-right National Republican Convention and the centre-left Social Democratic Party. This full transition to this planned republican government was truncated following the annulment of the 12 June 1993 presidential election despite democratically elected state governors and state assemblies voted in by the elections of 14 December 1991 and National Assembly representatives elected on 4 July 1992.

The subsisting 1999 Constitution came into force through the promulgation of Decree No. 24 of 1999 on 5 May 1999 by General Abdusalam Abubakar. Section 2 of the constitution affirms a Federal Republic of Nigeria consisting of states and a federal capital territory. The legitimacy of the federal principle embedded in the 1999 constitution has been questioned by many political analysts like Chief Emeka Anyaoku, Nigeria’s former representative to the United Nations and the third Commonwealth Secretary-General, on the basis of the fact that its preamble contains the declaration, ‘We the people of the Federal Republic of Nigeria’, even though it came into being through a unilateral military decree.

THE SPIRIT OF NIGERIAN FEDERALISM

In the premier American treatise on federalism, The Federalist, John Jay, quoting the British Queen Anne in her 1 July 1706 letter to the Scottish Parliament, wrote:

An entire and perfect union will be the solid foundation of lasting peace: It will secure your religion, liberty and property; remove the animosities amongst yourselves, and the jealousies and differences betwixt our two kingdoms. It must increase your strength, riches and trade; and by this union the whole island, being joined in affection and free from all apprehensions of different interest, will be enabled to resist all its enemies.

Jay then advocated for a united states of America through the principle of federalism by arguing that ‘should the people of America divide themselves into three or four nations…envy and jealousy would soon extinguish confidence and affection, and the partial interests of each confederacy, instead of the general interests of all America, would be the only objects of their policy and pursuits.’

Going by the above sentiments, federalism then, when properly accounted for, is the independent union of all the constituent parts of a nation into a stronger whole, each fraction vested with its corresponding rights and responsibilities. And in the Nigerian context, the spirit of federalism is about the seamless alignment of all the geographical contiguities that criss-cross the Nigerian area into a plural Nigerian state, for the ultimate purpose of serving the varied interests of the Nigerian people.

And yet this view of federalism in Nigeria cuts through even during the most abusive periods of the Nigerian national life, no? At the constitutional conference convened by the General Sani Abacha military junta on 27 June 1994, the delegates settled that Nigeria should employ a federal system of government after agreeing on the definition of federalism by Professor K.C. Wheare, a pioneer of modern comparative federalism research. Wheare described a federal government as one that exists where the powers of government for a community are divided substantially according to the principle that there is a single independent authority for the whole areas in some matters and independent regional authorities for other matters, each set of authorities being coordinate with and not subordinate to the others. The committee further concluded that federalism would be an appropriate system for the group of states within Nigeria who wished to be united under a single central authority but at the same time desired to be autonomous with respect to certain matters.

Nigeria would be ushered into its fourth democratic republic on 29 May 1999 via Decree No. 24 of 1999 by then head of state, General Abubakar, but the constitutional framework that underpinned the transition to civilian rule was based on the federal principle that was roughly cast in stone since as far as the Richards constitution of 1946 which created the northern, eastern and western regions. Yet the 1999 constitution eventually passed by Abubakar was based on a modified version of the 1979 constitution, which deviated from the British Westminster parliamentary system of government that prevailed in the First Republic in favour of the Washington-styled presidential system of government—both models of government being two variation forms of a federal system of government.

At the British House of Commons debate on 15 July 1960 over the Nigerian independence constitution, Iain Macleod, a member of the British parliament and then secretary of state for the colonies, described Nigeria as ‘extraordinarily diverse in race, religion and in social and economic development.’ Perhaps then the Nigerian state’s recessive penchant for federalism due to these aforementioned notions of diversity can be summed up in the conditions of Committee No.1 of the 1995 constitutional conference, which acceded to federalism in the proposed 1995 constitution only on the following grounds:

It should be true federalism with clear demarcations of powers and functions among the levels of government; there should be equitable distribution of political and economic powers between the centre and the component units; there should be a strong, independent and impartial judiciary; the federating or component units should be economically viable and the system should promote peace, justice and growth in relation to the complexities of the federating units.

Nigeria is now well over two decades into a fourth republic running based on the same long-standing federal principle of a clear distinction of powers among the three tiers of government.

Section 2 (2) of the 1999 constitution provides that Nigeria shall be a Federation consisting of States and a Federal Capital Territory. Sections 4, 5, 6 and 7 of the Constitution delineate the legislative, executive powers and judicial powers available at the state, federal and local government levels.

The second schedule of the constitution describes the legislative powers exclusive to the federal government through the National Assembly and the legislative duties concurrently between the federal and state law-making bodies.

This clear distinction of powers as enshrined in the Nigerian constitution of 1999 shows that the careful separation of powers remains fundamental to the workings of any federal government of Nigeria.

Nonetheless, regardless of the fine print of the 1999 constitution, there remains a dissatisfaction with the current federalistic practice as epitomized by the words of Mike Ozekhome, a Senior Advocate of Nigeria, who has argued that ‘one million amendments of the 1999 constitution will never work,’ since Nigeria needs to organize itself around ‘true federalism’; that is, a federal system of government that will allocate powers equitably among the constituent units and effectively address the current political and economic challenges of the country.

The dire economic straits of a vast majority of the Nigerian states have led many political observers like Anyaoku and Ozekhome to term Nigeria’s federal structure a mere ‘feeding-bottle’ federalism consisting of component units that are not economically viable or imbued with full economic powers since they majorly survive by receiving federal monthly allocations from the Revenue Mobilization, Allocation and Fiscal Commission through the Federal Accounts Allocation Committee (FAAC) akin to babies who receive milk from a nursing bottle. The sub-national debt of Nigeria’s 36 states stands at over ₦4 trillion as of 31 March 2024 with little gainful socioeconomic development to show for it since over 87 million Nigerians live in extreme poverty in Nigeria, which ranks seventh lowest on the global human capital index.

Surely, the Nigerian founding fathers did not envisage poverty and low human capital development as the fulcrum of the Nigerian federalist principle. Therefore, the prevailing national socioeconomic consternation necessarily requires one requisite remedy through a clearly stated question: how can Nigeria remedy the fiscal challenges of its federalism?

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00

THE FISCAL CHALLENGES OF NIGERIAN FEDERALISM: ATTORNEY GENERAL OF RIVERS STATE V FEDERAL INLAND REVENUE SERVICE

Can there be an equitable revenue-sharing formula among the states in a federal system of government, and would that be a true federalistic practice? It would seem that there are no easy answers to this—at least within the Nigerian context.

In the book, The English Constitution, economist Walter Bagehot points out a latent defect of the American federal cum presidential system of government:

It is said that there must be in a Federal Government some institution, some authority, some body possessing a veto in which the separate states composing the confederation are all equal. I confess this doctrine has to me no self-evidence, and it is assumed, but not proved. The State of Delaware is not equal in power or influence to the State of New York, and you cannot make it so by giving it an equal veto in an Upper Chamber. The history of such an institution is indeed most natural.

While Bagehot was explaining why the American Senate or the ‘upper chamber’ was merely an artificial replica of the English House of Lords with members vested with concocted powers to veto inter-state laws, his opinion on the difference of the powers of the federal states is all the more prescient. When read through a finer lens, the point in Bagehot’s assertion is that federal states are unequal, independent and do not share the same rights and responsibilities. In other words, federal powers in a truly federal country are diverse, autonomous and autochthonous, thus the ‘State of Delaware is not equal in power or influence to the state of New York’.

Awolowo succinctly explained this inequality of states (and powers) in a federal system of government in an interview conducted with a British journalist in 1957: ‘under a (federal) constitution, certain matters like defence, foreign affairs, ports and railways are exclusive federal subjects; all other matters which are not declared exclusive federal subjects are residual subjects over which the regions have authority.’

Put together, Bagehot and Awolowo mean that the essential element of federalism is the difference of powers, rights, strengths and responsibilities amongst federating bodies.

Yet the current practice of federalism in Nigeria is a far cry from this ideal. For instance, after the Federal High Court declared in the case of Attorney General of Rivers State v Federal Inland Revenue Service (2021) that the federal government, through its agent, the Federal Inland Revenue Service (FIRS) did not have the constitutional power to create and disburse a national Value Added Tax (VAT) pool by collecting the VAT in state territories as the tax was not listed in item 58 and 59 of the exclusive legislative list of the constitution, the Gombe State governor at the time, Inuwa Yahaya, almost immediately confessed that ‘there will be hunger in Gombe’ if the VAT pool is restructured.

Presently, the VAT rate is 7.5 percent. However, 80 per cent of the total VAT collected in Nigeria comes from only five states: Lagos, Rivers, Oyo, Kaduna, Delta and Katsina, given that these are the most commercially vibrant states in Nigeria. Nonetheless, the current VAT allocation system is questionable. For instance, in 2021, Nyesom Wike, the governor of Rivers State, claimed that the state received a paltry ₦4.7 billion in June 2021 from the FG out of the ₦15 billion VAT collected in the state during the fiscal year while Kano state got ₦2.8bn in June 2021 from the ₦2.8bn VAT generated in the state.

VAT sharing is contentious because VAT earnings are distributed according to a VAT pool created by Section 40 of the VAT Act. The law states that 15 percent of the total VAT earnings collected across Nigeria shall go to the federal government, 50 per cent shall be distributed amongst the 36 states of the federation and the federal capital territory while the remaining 35 percent shall be disbursed to the 774 local governments across Nigeria.

Nonetheless, this system of VAT distribution appears inequitable to the major VAT earning states like Rivers and Lagos. This was why Wike instituted a case in court in 2021 through the Rivers state attorney-general, after which he argued that ‘Rivers VAT (is) not for Abuja people, I don’t care if heaven falls.’ But Governor Yahaya, Wike’s Gombe state counterpart, did care; by saying that ‘there will be hunger in Gombe’, if the VAT pool is restructured, Yahaya meant that Gombe State’s economic survival depended on the revenue aggregated and collected from across Nigeria made up of earnings largely from economically upward states like Rivers and Lagos.

shop the republic

shop the republic

ENSHRINING FISCAL FEDERALISM IN NIGERIA THROUGH GREATER POWER DEVOLUTION

Since federalism is about national unity under a single central authority but state autonomy with respect to certain local matters, a primary place to correct Nigeria’s federalism is for the current practice of monthly federal allocation of revenues to states to be stopped since it is not aligned with the true principle of federalism.

Section 162 (3) of the 1999 constitution states that any amount standing to the credit of the ‘Federation Account’ shall be distributed among the federal, state and local governments on such terms and in such manner as may be prescribed by the national assembly. This legal provision forms the basis of the monthly federal revenue-sharing practice to the federal government, states and local governments in Nigeria through an allocation system prescribed by the FAAC.

While this allotment to different states of the federation takes into account the principle of derivation, population, ‘equality states’, internal revenue generation, land mass, terrain, and population density, it violates the lucid principle of federalism. States within the federation ought to be fiscally self-sufficient without any routine allocation in the form of handouts from a federal committee by virtue of a robust state internal revenue generation mechanism that makes the federal government, states and local governments fiscally independent of each other as much as possible—albeit with minor overlaps.

However, this pristine model of federalism cannot work in Nigeria currently because states in the federation are unable to generate sufficient revenue to finance economic growth as the rights to the major means of revenue generation have been legally ceded to the federal government, including four of the most important income sources from customs duties, mineral oils, company income taxes and foreign trade as contained respectively in items 16, 39, 59 and 62 of the exclusive legislative list. While oil and gas earnings from royalties, taxes and other arrangements contribute, at least, 65 per cent to the federation account, ₦500 billion (or 23 per cent) of the April 2024 FAAC allocation to the three tiers of government came from VAT and electronic money transfer levies.

Regardless, states are simply vassals to the federal entity in the entire process as the collection rights of these revenues from minerals and taxes and the lion’s share all go to the federal government. Under the current FAAC revenue sharing formula, the federal government gets 52.68 per cent of the revenue shared, states get 26.72 per cent while local governments get 20.6 per cent; a 13 per cent fee based on the principle of derivation is also credited to the account of the oil producing states, amongst other allocation considerations.

This current centralized mode of governance where all the major rights are concentrated at the centre dates back to General Aguiyi Ironsi’s Unification Decree no. 34 of 1966, which bestowed large swaths of power in the head of the federal military government so as to dissuade sectional affinities.

A sustainable solution to this fiscal impasse would be for the federal government to devolve greater power to the states so they have the rights to the mineral oils within their lands while also having the ability to collect state versions of corporate and value added taxes; the federal government can then sustain itself majorly through oil proceeds from offshore fields, federal taxes paid by mineral producing states, a federal value added tax, federal corporate tax and customs and excise duties just as it is currently done in the US and other developed federal countries. Nevertheless, this power shift will be tectonic for the entire Nigerian entity in actual practice, aside from the fact that the national tax net will have to be widened and properly restructured. On resources, Section 44 (3) of the 1999 constitution will have to be rewritten so that all the mineral oils vested in the ‘government of the federation’ shall belong to the regions where they are found.

Former president, Olusegun Obasanjo, for instance, in a response in 2021 to prominent Ijaw chief, Edwin Clarke, contended that any minerals found anywhere within Nigeria belongs to Nigeria and not to any region. The Obasanjo presidency also secured a major supreme court judgement in 2001 that affirmed the ownership of all offshore oil and gas resources with the federal government of Nigeria.

On the argument that all mineral resources found under Nigerian soil vests in the Federal Republic of Nigeria, Abubakar Umar Kari, an associate professor of political sociology at the University of Abuja, sides with Obasanjo; like Obasanjo, Kari opines that ‘everything’ belongs to the federal government, he also cites the position of Dr. Yusufu Bala Usman, a former Nigerian politician and historiographer to back up the claim that no component unit of Nigeria can claim ownership to any natural resource.

Nevertheless, Obasanjo, Kari and Usman’s positions on resource control are all far from complete. Pursuant to the property clause (article IV, section three, clause two) of the constitution of the United States—the jurisdiction from which Nigeria borrowed the presidential system of government that formed the basis of the 1979, 1993 and 1999 republics—it is trite that the US federal government has the legislative and regulatory power to control the production of resources found under federal land and those resource activities conducted across state lines under the ‘commerce clause’ based on article I, section eight, clause three of the US constitution. Thereafter, individual states and private entities have the autonomy to control resources like oil, gas and coal found on state and private lands through the exercise of harvesting rights subject to a variety of restrictions.

In totality, constituent states in a federal arrangement should not be vassals of the federal government; they should consistently challenge and rearrange their rights and responsibilities through legally acceptable means. The position by Obasanjo that the governments of the Niger Delta states have not fully utilised the revenues shared with them under the 13 percent derivation principle should not also preclude equitable resource allocation; rights must be initially accorded before due accountability can follow.

Lagos and Rivers states have both attempted to enact their own value added tax law that applies to goods and services within their state since 2021, but the Federal High Court has suspended implementation of these laws so as to avoid the incidence of double taxation; Lagos also initially enacted a sales tax, a narrower form of the VAT, on 1 January 1994 (and amended the law on 2 November 2000) but the Supreme Court also ruled this tax as unconstitutional on 8 December 2017 because the federal VAT already covered the field.

The politics of resource sharing aside, the Nigerian nation will continue to experience a litany of unrest until all the indigenes of the federating states feel properly pacified by acceding to them what is theirs; the ceaseless agitations in the Niger Delta since the days of Ken Saro-Wiwa’s Movement for the Survival of the Ogoni People are prime examples of this. Going by precedence, the regional governments of pre-independence Nigeria had far-sighted industrialization programmes due to a federal structure that allowed them the autonomy to handle foreign trade, engage in public-private partnerships and mine their mineral resources.

In 1956, the western Nigeria regional government would go on to confirm the availability of limestone deposits in Ewekoro village in a bid to mine it, emphasizing its rights to the minerals found within the region. The political twists of the early 1960s and the intermittent military takeover of power have all made room for more concentration of powers to accrue in the centre; many states that were created by military decrees due to self-determination efforts also find it increasingly hard to sustain themselves and have to rely on federal monthly allocations as their cost of governance rises.

Nigeria currently practises its unique model of federalism, which has a peculiar unitary tint. Here, the federal government owns all mineral rights under any land in the country and can exclusively legislate on 68 items in part one of the second schedule of the constitution, including on critical issues like defence, taxation of incomes and many other incidental matters.

By virtue of the fifth amendment of the 1999 constitution, the federal and state governments currently have joint custody of legislative rights over electric power generation alongside industrial development, railway construction and other preexisting matters codified in the second part of the second schedule of the constitution. The country also maintains a federation account where all revenues collected by the government of the federation are paid to the three tiers of government: federal, state and local government.

This unitary cum federal model of government is far from perfect, but it has a Nigerian sense to it. Perhaps, through a longer democratic practice, the states within the federation will take on more rights and responsibilities so that governance can fully reach the people at the lowest level⎈

shop the republic

BUY THE MAGAZINE AND/OR THE COVER

-

The Republic V8, N3 The Enduring Voice of Wole Soyinka

₦24,000.00

US$49.99 -

‘Kongi’s Harvest’ Print by Diana Ejaita.

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page