Photo illustration by Michael Emono / THE REPUBLIC.

THE MINISTRY OF WORLD AFFAIRS

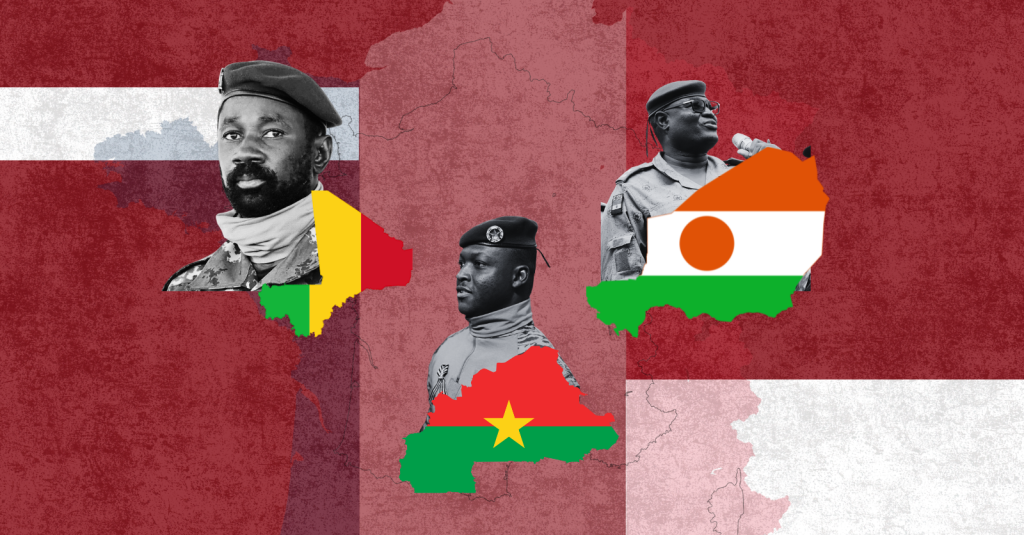

Is the Spate of African Coups Affecting the French Economy?

Photo illustration by Michael Emono / THE REPUBLIC.

THE MINISTRY OF WORLD AFFAIRS

Is the Spate of African Coups Affecting the French Economy?

On 8 September 2025, French lawmakers voted on a confidence vote called by the embattled prime minister, Francois Bayrou. Bayrou called the confidence vote due to his inability to pass an austerity budget which he argued was necessary to prevent an ‘existential’ economic threat facing the country. He argued that France needed to address its 2.4 trillion-euro liabilities arising from an unsustainable level of debt.

Since 2021, France has witnessed a decline in economic growth. While the gross domestic product (GDP) growth rate was 6.8 per cent in 2021, it declined to 2.57 per cent in 2022 and then 0.94 per cent in 2023. Although the trend is similar to other European countries—primarily due to the war in Ukraine—the rising level of debt makes the situation in France more precarious. A key question is whether France’s ailing economy has any connection to the recent spate of coups and subsequent loss of key long-term allies in Francophone Africa.

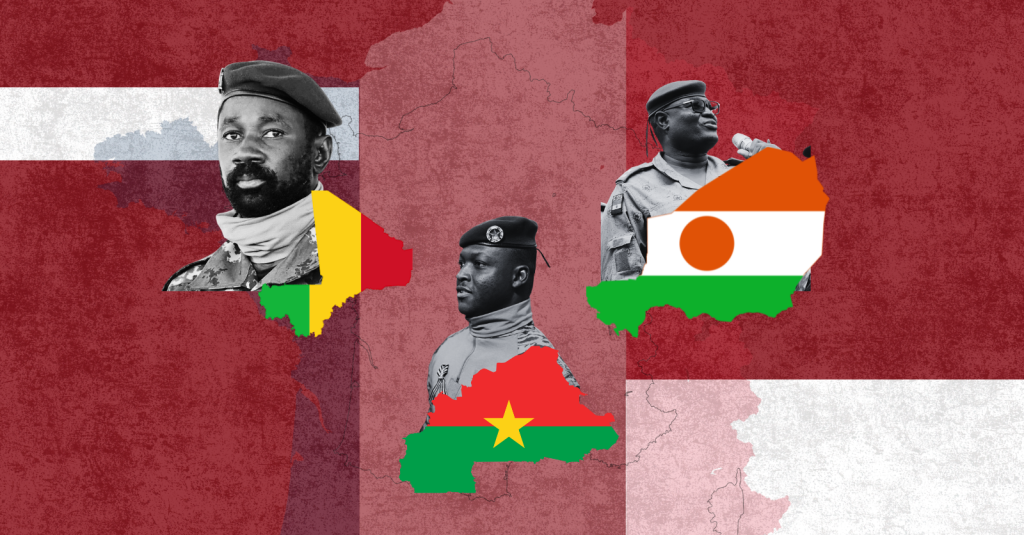

Since 2022, five military coups have occurred in Francophone Africa: two in Burkina Faso (January and September 2022), one in Niger (July 2023), and one in Gabon (August 2023)—in addition to the coup in Mali in May 2021. The coups have resulted in some of these countries severing economic and military ties from France. Notable ones are Mali, Burkina Faso and Niger, who ended their long cordial relationship with France and are cozying up to Russia instead.

I have written extensively on the spate of coups in West Africa and the implications for regional and international stability. I believe that the coups and subsequent realignment of key Francophone countries have somewhat contributed to France’s economic woes. Key economic indicators such as stock market performance, access to raw materials, future investment trends and sales of military hardware are all factors that might have been impacted by the loss of a key market to the French economy.

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00

STOCK MARKET PERFORMANCE

Studies show a negative correlation between coups in French-speaking Africa and stock market performance of French companies, particularly those with significant operations or investments in the region. A study by Whelsy et al. highlights the impact of the coups in Francophone Africa on the stock market performance of French companies. The authors analysed the stock prices of 197 French companies between September 2020 to September 2023. They argued that the spate of coups had a negative impact on the stock market performance of French companies.

French companies in the extractive industries have been particularly affected. In June 2024, Niger’s military government revoked the operating licence of French nuclear fuel producer Orano. In June 2025, Burkina Faso revoked the mining permits of foreign companies. This move is reported to have negatively impacted French investors. Through loss of earnings and inability to recoup some investments in the region, French companies have been negatively impacted.

shop the republic

LOSS OF A MARKET SHARE

Although most Francophone countries in Africa gained independence from France from the 1960s, the countries remained attached to France in several ways. In 1962, French president, Charles de Gaulle, commissioned one of his advisers, Jacques Foccart, to establish Françafrique. The aim was to establish a sphere of influence over the French colonies. Foccart developed a network of personal contacts between elites in Francophone West Africa and France. The elites were saddled with the responsibility of protecting French interests in the region. This resulted in some treaties that are still in force today.

France, for instance, developed a mechanism whereby it retains the right of first refusal on all natural resources discovered in Francophone countries. This explains why many extractive companies in these countries are of French origin.

France sustained the relationship in its former colonies for its own economic interests. This relationship has disproportionately benefited the European nation at the expense of its former colonies. Before the coups in the 2020s, France dominated trade through its economic influence and the CFA franc currency. These coups have resulted in significant decline in African countries’ exports to France as well as their imports from France.

Although it is too early to understand the full impact of the loss of market share in West Africa on the French economy, a 2024 research by Transatlantic Policy Quarterly has shown that France has lost a significant market share in the region with China making most gains. According to French government nuclear officials, Nigerien uranium has been indispensable to France’s energy independence since the 1970s. Before the coup, Niger supplied 20 per cent of the uranium that powers France’s nuclear reactors. As of June 2025, Niger does not supply uranium to France.

Ultimately, the destabilization of former colonies and increased anti-French sentiment can result in reduced French access to lucrative markets and resources in the long term.

shop the republic

SALES OF MILITARY HARDWARE

France is the second largest exporter of major arms in the world. While France remains a major supplier of military hardware to African countries, shifting security dynamics and rising anti-French sentiment has led to a loss of market share.

Several francophone countries such as Senegal, Mali, Niger, Chad and Burkina Faso have cut military ties with France. These countries are now turning to Russia and China for their military hardware. Russia currently provides about 40 per cent of arms imports to Africa. This represents a significant shift because Russia provided just 11 per cent of arms imports to Africa in 2015. Although it could be argued that France has not been a major supplier of arms to Francophone countries even before the coups, any loss of market share could be significant in the long term and could strengthen the positions of non-Western allies.

As President Emmanuel Macron reshuffles his government yet again, attention will likely turn to formerly strong allies who have become foes, and to the potential implications of the loss of relationships on France’s fragile economy⎈

BUY THE MAGAZINE AND/OR THE COVER

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

The Republic V9, N3 An African Manual for Debugging Empire

₦40,000.00

US$49.99