Photo illustration by Dami Mojid / THE REPUBLIC.

THE MINISTRY OF CLIMATE CHANGE

Who Will Own and Control Africa’s AI Energy Future?

Photo illustration by Dami Mojid / THE REPUBLIC.

THE MINISTRY OF CLIMATE CHANGE

Who Will Own and Control Africa’s AI Energy Future?

As artificial intelligence sweeps across Africa, powering everything from data centres to digital economies, several critical questions loom: how will the continent meet AI’s massive energy demands without repeating old mistakes? What if Africa’s rapid turn to solar energy and imported Chinese panels, driven more by affordability and failing grids than by climate ideals, actually represents a new chapter in green extractivism? What happens when AI’s enormous electricity and water footprint meets the limits of renewables alone, forcing reliance on hybrid systems that still depend heavily on fossil fuels? In the end, Africa’s digital revolution is at a crossroads: it will either build true energy sovereignty or become an AI-powered extension of the same extractive systems that have historically defined Africa’s relationship to global capital.

Artificial intelligence is often hailed by global institutions such as the World Economic Forum and the United Nations Educational, Scientific Cultural Organization as the next frontier of global development. Its growth, including in Africa, holds the promise of significant advances across various sectors, including energy. Yet, a paradox emerges. The same digital revolution that powers these gains could also deepen environmental harm. AI data centres, known for their intensive energy demands, risk locking the continent into energy pathways that may undermine its climate and development goals. Because such infrastructure requires enormous amounts of electricity, water and critical minerals, it may entrench Africa’s role as both an energy supplier and a site for the externalization of environmental costs, making the debate over AI inseparable from questions of extractivism. This concern is amplified by the widespread perception within the engineering community that green energy alone cannot generate the stable, large-scale power required to sustain AI infrastructure. In this context, more pressing concerns arise. Across Africa, much of the renewable build-out is being driven by Chinese-manufactured solar panels, which have become a symbol of the continent’s transition away from fossil fuels in the face of unreliable grids and rising diesel costs.

AI’S ENERGY FOOTPRINT

AI is not merely another digital tool; it is computationally intensive in ways that far exceed traditional internet use. Training a single large language model, such as GPT‑3, requires around 1,287 MWh of electricity, equivalent to the annual consumption of approximately 120 average homes in the United States. This massive energy consumption stems from the need to run thousands of graphics processing units in parallel, which both demand more electricity and generate significantly more heat than standard central processing units. As a result, cooling systems must work harder, often using evaporative processes or chillers, which in turn consume vast amounts of water. For example, data centres in the United States consumed over 660 billion litres of water in 2020, with industry sources warning that AI‑driven expansion could drive withdrawals to over 1.2 trillion litres per year by 2030.

In Africa, these dynamics carry heightened importance. Efforts to localize data and deploy sovereign AI platforms may significantly increase demand for local AI‑ready data centres. Unlike standard cloud or server operations, AI systems must run continuously at peak capacity, leaving no room for interruptions or power variability. This creates a dual vulnerability, first to unstable, underdeveloped electrical grids, and second to growing water stress in many regions. Africa’s electricity systems remain fragile, many countries suffer frequent outages and unreliable supply, which undermines the continuous power demands of AI‑ready data centres. According to Ember, clean energy met 54 per cent of Africa’s electricity demand growth over the last five years, but nearly half of new demand was still met with fossil fuels. Meanwhile, as of October 2022, about 226 million people in East and Southern Africa lacked access to basic drinking water services, and 381 million lacked sanitation, highlighting severe pressure on water systems. These overlapping crises illustrate that AI’s reliance on stable power and intensive cooling could collide with real constraints across grid infrastructure and water availability.

Moreover, the energy and mineral demands of AI infrastructure are deeply interlinked with the broader extractive economy. African nations supply a significant portion of the world’s critical minerals, roughly 30 per cent of global reserves for materials like cobalt, lithium and rare-earth elements, yet capture only around 10 per cent of the associated revenue. As AI systems scale up, these minerals are in high demand to build the chips, batteries and infrastructure that power data centres. For instance, a 2025 Barclays analysis highlighted that more than 60 per cent of essential raw minerals for AI hardware now originate from a handful of developing countries, a concentration that leaves global supply chains vulnerable.

Academic work has increasingly framed this as a form of ‘digital extractivism’ akin to environmental and resource exploitation, in which AI accelerates the export of raw materials while externalizing environmental and social costs. Without strategic infrastructure planning, such as investment in local value addition, sustainable cooling designs, or recycling networks, the expansion of AI may worsen ecological degradation, water stress, and entrenched inequalities, undermining climate goals rather than supporting them.

shop the republic

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Make the World Burn Again’ by Edel Rodriguez by Edel Rodriguez

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 -

‘Nigerian Theatre’ Print by Shalom Ojo

₦150,000.00 -

‘Natural Synthesis’ Print by Diana Ejaita

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00

GREEN EXTRACTIVISM AND GEOPOLITICS

Africa’s embrace of solar energy is often framed as a climate-conscious leap, but several studies suggest the driving force is primarily affordability and the urgent need to address chronic grid instability rather than climate mitigation alone. One only needs to ask the millions of Nigerians frustrated by blackouts and unstable power supply, or South Africans navigating the inconvenience of load shedding, who see solar panels as a Hail Mary to keep the lights on rather than this climate-conscious leap. But this practical response to infrastructure failure has deeper implications that extend beyond individual energy choices. Research on energy transitions in South Africa by political scientist Tobias Kalt and colleagues identifies how ‘green’ energy development can slide into green extractivism, where infrastructure is shaped to meet external markets and investment flows rather than local energy justice.

Political economist and scholar of political ecology Natacha Bruna’s work on Mozambique adds a sharper critique, showing how the language of sustainability can mask the extraction of resources and emission rights from rural communities to feed global ‘green’ capital accumulation. In her 2023 book, The Rise of Green Extractivism, Bruna defines green extractivism as ‘the process of extracting and expropriating emission rights from rural poor while feeding and legitimizing external capital accumulation with adverse implications to extractive regions.’ Seen through the lens of how ostensibly ‘green’ energy solutions can replicate older inequalities by transferring environmental costs to vulnerable populations while enabling resource flows to wealthier markets, the race to power AI-ready data centres risks hardwiring these same extractive relationships into Africa’s digital future, even as it wears the language of progress and innovation.

In the case of solar photovoltaic systems, that is, solar panels that convert sunlight directly into electricity using photovoltaic cells typically made from silicon, environmental studies professor, Dustin Mulvaney’s analysis highlights the heavy embodied emissions and ecological costs of Chinese-made panels, whose polysilicon production is concentrated in coal-powered Xinjiang and reliant on critical minerals sourced from Africa itself. China, the world’s largest producer, powers much of its solar supply chain with coal-fired electricity, and nearly 80 per cent of global polysilicon production occurs in China, predominantly in Xinjiang, where coal-based energy is the norm. The extraction of quartz, copper, and rare earth elements needed for solar modules also generates toxic by-products, including heavy metals and radioactive waste.

A 2012 review of rare earth elements by Robert J. Weber and David J. Reisman presented at the US Environmental Protection Agency estimates that rare earth extraction can produce up to 2,000 tonnes of waste per tonne of rare earth mined. These upstream impacts are compounded by weak end-of-life planning. In this context, weak end-of-life planning refers to the lack of systems to collect, process, recycle, for safely dispose of solar modules and batteries once they expire. Across much of Africa, there is little infrastructure to manage electronic waste. The United Nations’ 2023 Global E-waste Monitor reports that Africa only recycles around one per cent of its e-waste, and solar technologies, particularly off-grid units, are rarely accounted for in existing systems. A 2022 study by the Global Off-Grid Lighting Association also found that few solar companies on the continent have effective take-back schemes or recycling pathways for expired systems.

The risks extend beyond solar technology itself. Africa supplies many of the critical minerals used in renewable energy and AI hardware, including cobalt and rare earth elements. The Democratic Republic of the Congo provides over 70 per cent of the world’s cobalt, much of it mined under hazardous conditions, while lithium and graphite extraction projects are expanding in Zimbabwe and Mozambique. Without local processing capacity or strict environmental governance, the continent risks being locked into a dual role as both a site of extraction and as a dumping ground for the waste generated by the global energy transition. The African Development Bank’s assessment on rare earth elements shows that the absence of local refining and beneficiation, where raw minerals are exported without doing the initial processing steps that would add value and reduce shipping costs, results in raw mineral exports that leaves countries highly vulnerable to both environmental degradation and global price shocks. Similar 2024 findings from the UN Economic Commission for Africa stress that without domestic processing capacity, African states risk remaining on the lowest rung of the clean-energy value chain while absorbing the ecological costs.

These dynamics raise serious concerns about environmental justice. While wealthy countries shift toward low-carbon technologies, African nations increasingly serve as markets for resource-intensive goods produced with high emissions and toxic waste. Later, these same countries are likely to bear the burden of disposal. African leaders have begun to raise these concerns, with a 2024 resolution calling for equitable benefit-sharing in the extraction of transition minerals used in solar and battery technologies. Together, these studies and interventions suggest that Africa’s AI energy transition risks becoming a textbook example of green extractivism, a system where the continent’s resources, energy systems and ecosystems subsidise global ‘green’ ambitions while the costs are borne locally. All evidence points us to the fact that the conversation on AI and energy in Africa cannot be separated from extractivism, as the continent’s digital future is being built within a global system that has long externalized costs southward. The AI energy question makes clear that the issue is not only technical but also political and historical; it is about whether Africa’s AI future will replicate the continent’s past as a site of extraction or chart a path to true energy autonomy.

CLEAN ENERGY AND AI’S POWER DEMANDS

Even as Africa risks falling into patterns of green extractivism through solar infrastructure, what further complicates this narrative is that renewable energy alone is fundamentally insufficient to meet AI’s relentless power demands. This complication creates a double bind that deepens the extractivism dilemma. Due to weather variability, renewable energy sources such as solar and wind are inherently intermittent, making them unreliable as standalone power sources for data centres that require uninterrupted, high-quality electricity around the clock. A 2021 study by S&P Global found that although solar and wind contribute more than 20 per cent of the United States’ energy capacity, their capacity factors (24 per cent for solar and 38 per cent for wind) indicate that they often fail to deliver power consistently. Moreover, grid operators must continuously balance supply and demand, a task made more difficult by sudden changes in weather such as cloud cover or drops in wind speed that can occur within seconds. In practice, countries like Britain, Northern Ireland and Germany have had to curtail between 10 and 30 per cent of wind and solar output due to limitations in grid capacity. Real-world incidents such as the 2016 blackout in South Australia illustrate the risks of relying too heavily on renewables without sufficient backup. A severe storm damaged transmission lines and triggered a cascading failure that left around 850,000 homes and businesses without power.

Although Tesla’s 100 MW/129 MWh Hornsdale Power Reserve provided important grid support after its 2017 installation, it only sustained full power output for approximately 78 minutes, far less than the continuous supply needed to operate large AI data centres. In contrast, those facilities typically require steady power output for days or even weeks. Moreover, most African nations currently lack any comparable grid-level storage systems, making dependence on renewables alone a risk rather than a solution. Taken together, these facts reinforce the conclusion that renewable energy, in its present form, remains insufficient as the sole power source for AI infrastructure.

This forces Africa into another impossible choice. The continent can pursue renewable energy systems and risk both green extractivism and unreliable power for AI infrastructure. Or it can turn to hybrid systems that combine clean energy with fossil fuel backup, entrenching the very carbon dependencies that the green transition was meant to phase out. Facilities like Mali’s Fekola Hybrid Power Station that blend solar with diesel generators may become permanent rather than transitional, locking Africa into fossil fuel dependencies because it is trying to build a digital future.

shop the republic

THE RISE OF AI-READY DATA CENTRES

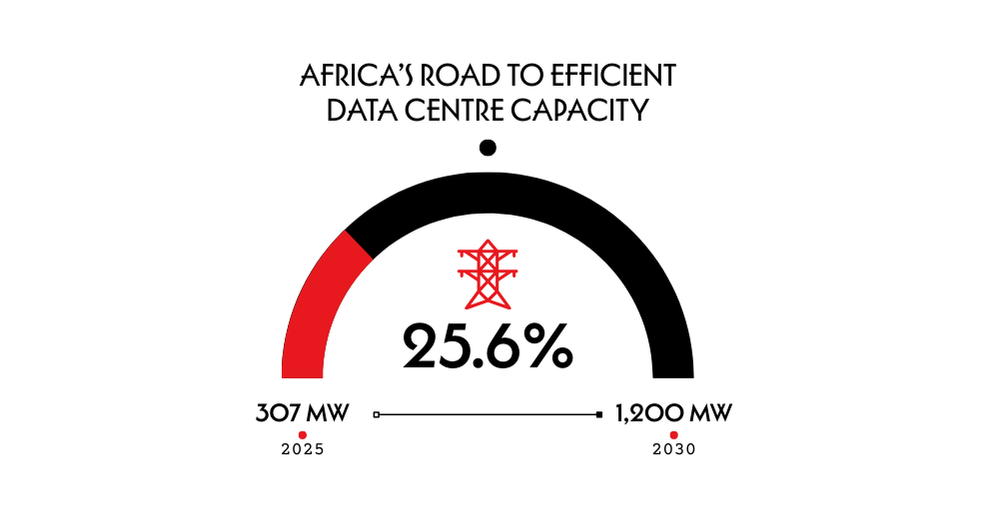

Across Africa, data centre capacity is expanding but remains modest relative to projected demand. According to the Africa Data Centres Association, the continent currently has around 307 megawatts of installed data centre capacity, which accounts for less than two per cent of the global total. These facilities are concentrated in countries such as South Africa, Nigeria, Egypt, Kenya and Morocco. However, to meet growing digital infrastructure needs, including cloud services, AI development and regional connectivity, the continent will require an estimated 1,200 megawatts of data centre capacity by 2030, spread across approximately 700 facilities. This reflects a significant gap between current infrastructure and future requirements, and it underscores the urgent need for strategic investments in both energy and digital systems to support Africa’s technological trajectory. The expansion includes newer ‘AI-ready’ data centres, such as IXAfrica’s 4.5 MW NBOX1 facility in Nairobi, which is already aiming for AI workloads.

Indeed, recent developments across the continent reflect growing interest in building high-performance data infrastructure. In Nairobi, IXAfrica and Schneider Electric opened the Tier III-certified NBOX1 facility in July 2024. It is capable of supporting advanced AI workloads and is designed to scale from an initial 4.5 megawatts to 22.5 megawatts. Microsoft and G42 have also announced a one-billion-dollar investment in a one gigawatt geothermal-powered data centre project near Olkaria, known as the EcoCloud facility. This initiative is the first of its kind in Africa and marks a significant milestone in combining clean energy with large-scale digital infrastructure. Meanwhile, Africa Data Centres expanded its capacity by 20 megawatts in Cape Town and Johannesburg in 2024. This expansion is supported by a 20-year power purchase agreement for solar energy and forms part of the company’s broader ambition to operate carbon-neutral facilities across the continent.

On the hyperscale front, Microsoft is investing an additional 5.4 billion rand, approximately 297 million US dollars, to expand its AI infrastructure in South Africa. This move significantly increases the company’s local footprint and signals growing confidence in the region’s digital potential. Meanwhile, the Raxio Group, backed by a 100-million-dollar investment from the International Finance Corporation, is constructing data centres in Ethiopia, Angola, Côte d’Ivoire, Mozambique, the Democratic Republic of the Congo and Uganda. Other global and regional players, including Equinix, Teraco, Vantage Data Centres, and Huawei Cloud, are also expanding their operations in South Africa and other strategic African markets, further contributing to the continent’s emerging digital ecosystem.

As this surge in digital infrastructure unfolds, the question of how to power it sustainably takes centre stage. While the continent has made strides in renewable adoption, almost doubling its renewable energy capacity in the past decade, the demands of AI-ready data centres place unique pressure on existing energy systems. The idea that solar and wind alone can shoulder this load is increasingly challenged by technical realities. Without a critical examination of these limitations, Africa risks building tomorrow’s digital foundations on energy systems that remain vulnerable, carbon-heavy, or externally dependent.

shop the republic

TOWARD A JUST AND SUSTAINABLE AI ENERGY FUTURE

Africa’s AI-driven energy transition sits at the intersection of climate ambition, technological aspiration and historical patterns of extraction. Hybrid systems that combine renewables with diesel or gas offer a pragmatic stop-gap, as seen in facilities like Mali’s Fekola Hybrid Power Station, yet they underscore the risk of fossil back-up becoming entrenched infrastructure rather than a bridge to fully decarbonised systems. Nuclear power, championed by technologists such as Sam Altman and policymakers like Kathryn Huff as the only scalable zero-carbon baseload for AI, remains a distant prospect on the continent outside South Africa’s existing plant and Egypt’s El Dabaa project.

But the deeper question extends beyond technology to political economy: who will own and control Africa’s AI energy future? As Bruna’s ‘Green extractivism and financialization in Mozambique: the case of Gilé National Reserve’ shows, South Africa’s hydrogen transition and Mozambique’s carbon schemes suggest, ‘green’ solutions too easily reproduce old extractive logics. The surge of Chinese-manufactured solar panels and imported data infrastructure risks creating a new dependency cycle, where Africa supplies critical minerals and hosts energy-hungry AI facilities while the value chains and environmental costs remain externalised. This is green extractivism in real time, repackaging colonial resource flows in the language of climate progress.

Avoiding this path requires more than swapping fossil fuels for solar panels. It demands phase-out frameworks that explicitly sunset fossil backup, investment in local manufacturing and recycling for solar and battery systems, and governance structures that embed energy sovereignty as a core principle rather than a slogan. Above all, it requires rethinking Africa’s role in the global digital economy not as a perpetual supplier of raw materials and hosting ground for ‘green’ infrastructure, but as a sovereign actor designing systems that serve its own people and ecosystems first. A just AI energy future for Africa must be one where powering the machine does not mean poisoning the well, where the continent’s digital revolution is built on circular, equitable systems that break extractive precedent instead of reinforcing it⎈

BUY THE MAGAZINE AND/OR THE COVER

-

‘The Empire Hacks Back’ by Olalekan Jeyifous by Olalekan Jeyifous

₦70,000.00 – ₦75,000.00Price range: ₦70,000.00 through ₦75,000.00 This product has multiple variants. The options may be chosen on the product page -

The Republic V9, N3 An African Manual for Debugging Empire

₦40,000.00

US$49.99